Starting a business in the United States can be a lucrative opportunity for non-residents. With a record-breaking 5.5 million new business applications filed in the US in 2023, the entrepreneurial spirit is thriving. This guide will walk you through the process of registering a US business as a non-resident, focusing on forming a Limited Liability Company (LLC). We’ll cover everything from choosing the right business structure to maintaining compliance with US regulations. By the end of this article, you’ll have a clear roadmap to establish your business in the US.

Choosing the Right Business Structure

Before diving into the registration process, it’s essential to choose the appropriate business structure. The most common structures for non-residents include:

Limited Liability Company (LLC)

An LLC is a popular choice due to its flexibility and protection from personal liability. It combines the benefits of a corporation and a partnership, making it an ideal structure for many entrepreneurs.

C Corporation

A C Corporation is a separate legal entity that offers limited liability to its owners. It can issue shares and attract investors, but it is subject to double taxation (corporate and personal).

S Corporation

An S Corporation is similar to a C Corporation but allows profits and losses to be passed through to the owners’ tax returns, avoiding double taxation. However, non-residents cannot be shareholders in an S Corporation.

Partnership

A partnership involves two or more people who share ownership and responsibility. While it offers flexibility, partners are personally liable for business debts.

Sole Proprietorship

A sole proprietorship is the simplest structure, where one person owns and operates the business. However, the owner is personally liable for all business obligations.

Selecting a State for Business Registration

Choosing the right state for your business registration is crucial. Popular states for non-residents include:

Delaware

Delaware is known for its business-friendly laws and tax benefits. It offers a separate court system for business disputes and does not require a physical presence in the state.

Wyoming

Wyoming is another popular choice due to its low fees, minimal reporting requirements, and strong privacy protections for business owners.

Nevada

Nevada offers no state income tax, low business taxes, and strong privacy protections. It is a favorable state for businesses seeking to minimize tax liabilities.

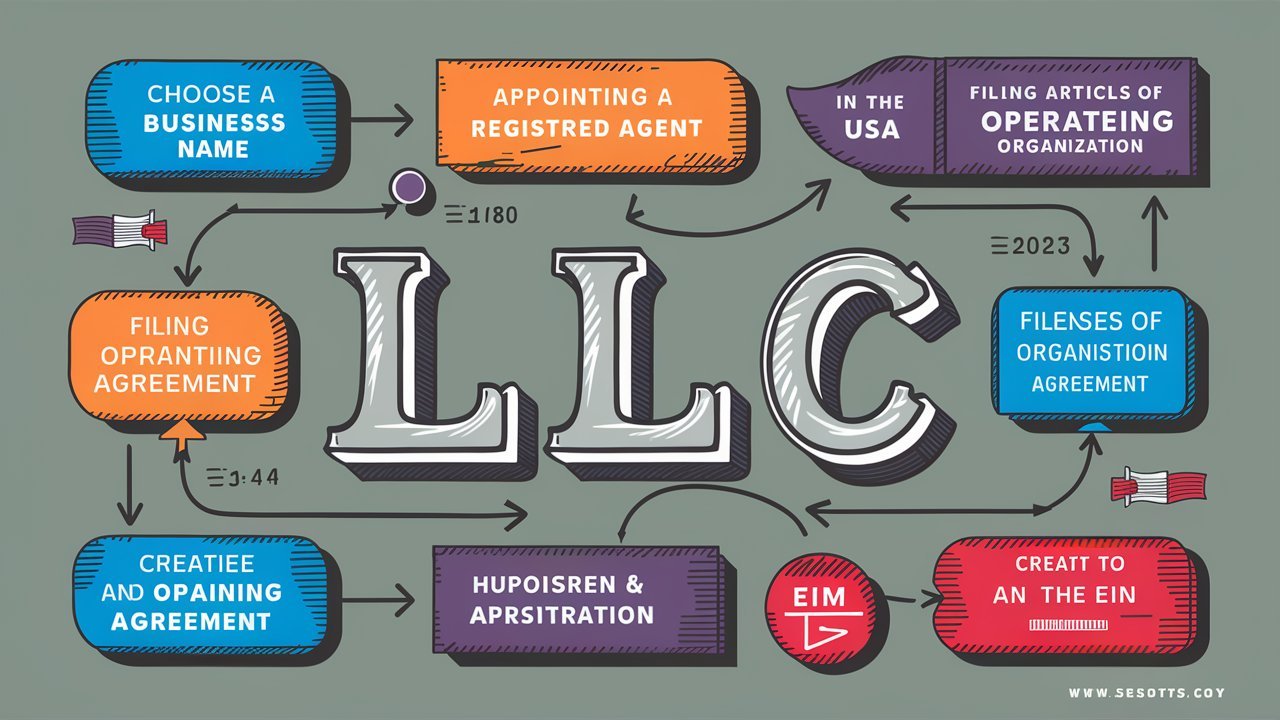

Registration and Compliance Process

Choose a Registered Agent

A registered agent is a person or entity designated to receive legal documents on behalf of your business. They must have a physical address in the state where your business is registered.

Register Your Business Entity

To register your LLC, you need to file the Articles of Organization with the state’s Secretary of State. This document includes essential information about your business, such as its name, address, and the names of its members.

Obtain an EIN

An Employer Identification Number (EIN) is required for tax purposes. You can obtain an EIN from the IRS online, by mail, or by fax. This number is essential for opening a bank account, hiring employees, and filing taxes.

Business Licenses and Permits

Depending on your business type and location, you may need various licenses and permits to operate legally. Check with local, state, and federal agencies to ensure you have all the necessary documentation.

Annual Reports and Franchise Taxes

Many states require businesses to file annual reports and pay franchise taxes. These requirements vary by state, so it’s essential to stay informed about your obligations.

Federal Tax Obligations

Non-residents must comply with US federal tax laws. This includes filing annual tax returns and paying taxes on income earned in the US. Consult with a tax professional to ensure compliance.

State Tax Obligations

In addition to federal taxes, you may be subject to state taxes, including income, sales, and use taxes. Each state has its tax laws, so it’s crucial to understand your obligations.

Banking and Financial Transactions

Opening a US business bank account is essential for managing your finances. You’ll need your EIN, Articles of Organization, and other relevant documents to open an account. Consider using a bank that specializes in international clients.

Setting Up Financial Infrastructure

Accounting and Bookkeeping

Maintaining accurate financial records is crucial for compliance and decision-making. Consider hiring a professional accountant or using accounting software to manage your books.

Tax Obligations

Understanding and fulfilling your tax obligations is essential for avoiding penalties. This includes federal, state, and local taxes. Consult with a tax professional to ensure compliance.

Payment Processing Services

Choose a reliable payment processing service to handle transactions. Stripe, PayPal, and Square are popular options that offer robust features for international businesses.

Financial Planning and Management

Effective financial planning and management are critical for business success. Develop a budget, monitor cash flow, and plan for future growth to ensure your business remains financially healthy.

Compliance and Reporting

Staying compliant with US regulations is essential for avoiding legal issues. This includes filing annual reports, paying taxes, and maintaining accurate records. Consider using compliance software to streamline this process.

Maintaining Legal and Regulatory Compliance

Federal Compliance

Ensure your business complies with federal laws and regulations, including tax laws, employment laws, and industry-specific regulations.

State and Local Compliance

In addition to federal compliance, you must adhere to state and local laws. This includes obtaining necessary licenses and permits, filing annual reports, and paying state taxes.

Corporate Compliance

Maintain corporate compliance by holding regular meetings, keeping accurate records, and filing required documents. This is essential for protecting your limited liability status.

US Labor Law Compliance

If you plan to hire employees, you must comply with US labor laws. This includes adhering to minimum wage laws, providing employee benefits, and maintaining a safe work environment.

Intellectual Property Compliance

Protect your intellectual property by registering trademarks, copyrights, and patents. This is essential for safeguarding your brand and products.

Data Privacy and Security Compliance

Ensure your business complies with data privacy and security laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). This includes implementing robust security measures to protect customer data.

Immigration and Visa Considerations

Types of Visas and Green Cards

If you plan to live and work in the US, you’ll need to obtain the appropriate visa. Common options for entrepreneurs include the E-2 Investor Visa, L-1 Intracompany Transfer Visa, and the EB-5 Immigrant Investor Visa. Consult with an immigration attorney to determine the best option for your situation.

Conclusion

Starting a business in the US as a non-resident is a complex but rewarding process. By following this step-by-step guide, you can navigate the registration and compliance requirements with confidence. Remember to choose the right business structure, select a favorable state for registration, and maintain compliance with US regulations.

For a seamless and efficient business formation process, consider using ZenBusiness, Inc.. They offer comprehensive services to help you start and manage your business, ensuring you stay compliant with all legal requirements.