Are you planning a trip to the USA and looking for the best travel insurance to ensure a worry-free experience? Look no further! In this comprehensive guide, we will delve into the nitty-gritty of travel insurance for USA travel, covering everything from understanding the basics of coverage options, eligibility criteria, and benefits to comparing different types of insurance plans, choosing the right insurance provider, and considering factors like destination-specific coverage and pre-existing medical conditions. We’ll also provide tips for getting the most affordable insurance, understanding the fine print of policies, and maximizing the benefits of travel insurance. Additionally, we’ll discuss how to ensure adequate coverage and stay informed about travel insurance regulations for the USA. By the end of this guide, you’ll be equipped with all the knowledge you need to select the best travel insurance for your trip to the USA. So, let’s get started and make sure you have the peace of mind you deserve while exploring the wonders of the United States!

Understanding the Basics of Travel Insurance for USA

Credits: cardplayercruises.com

Are you planning a trip to the USA and wondering about the best travel insurance options? Look no further! Understanding the basics of travel insurance for the USA is essential for a stress-free and enjoyable trip. Whether you’re visiting the bustling streets of New York City, exploring the natural wonders of the Grand Canyon, or soaking up the sun in Hawaii, having the right travel insurance coverage can provide you with peace of mind and financial protection.

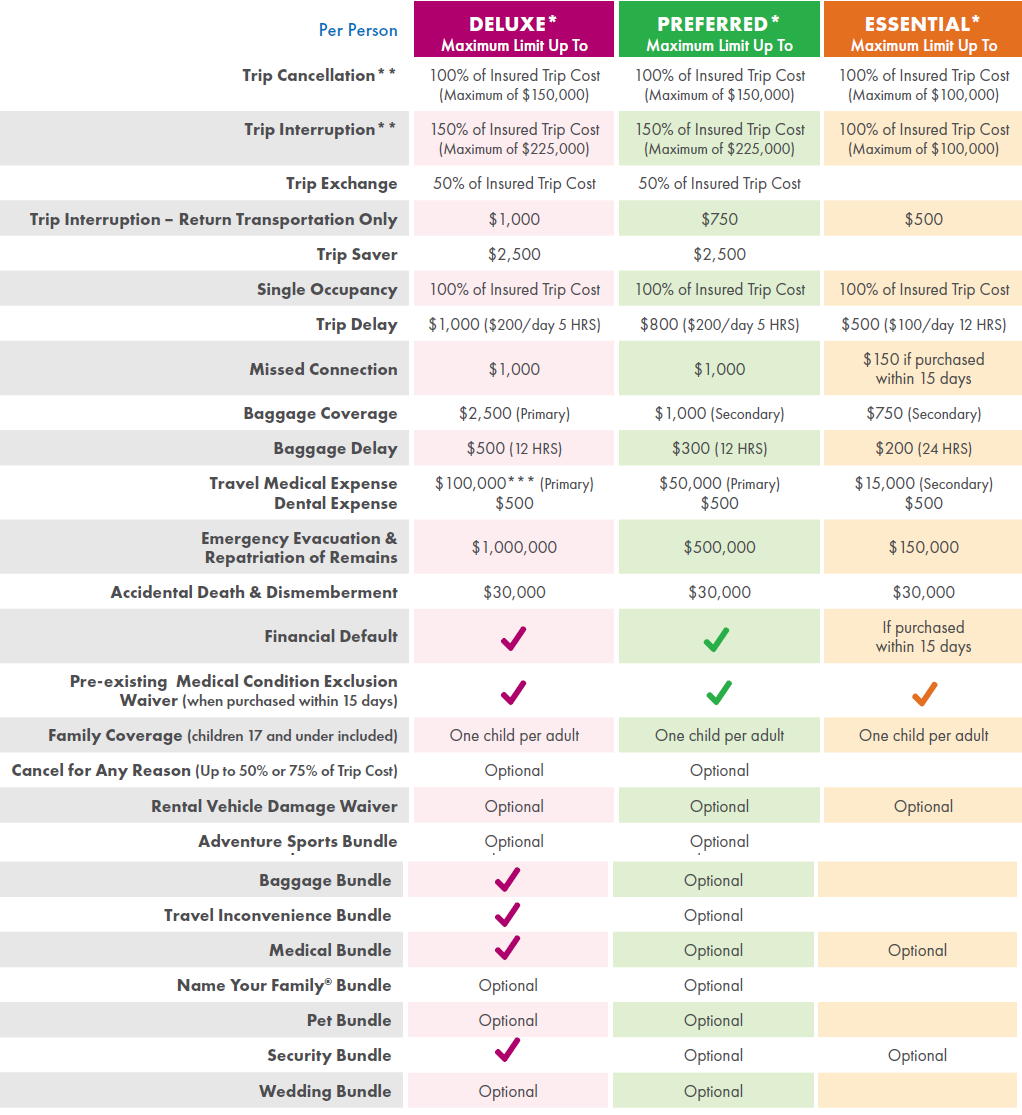

When it comes to coverage options, travel insurance for the USA typically includes medical coverage, trip cancellation/interruption coverage, and baggage loss/delay coverage. Medical coverage is especially crucial when traveling to the USA, as healthcare costs can be extremely high. With the right travel insurance plan, you can rest assured that you’ll have access to quality medical care without worrying about exorbitant expenses. Trip cancellation/interruption coverage protects your investment in case unexpected events force you to cancel or cut short your trip, while baggage loss/delay coverage reimburses you for any lost or delayed luggage, ensuring that you can continue your journey without unnecessary stress.

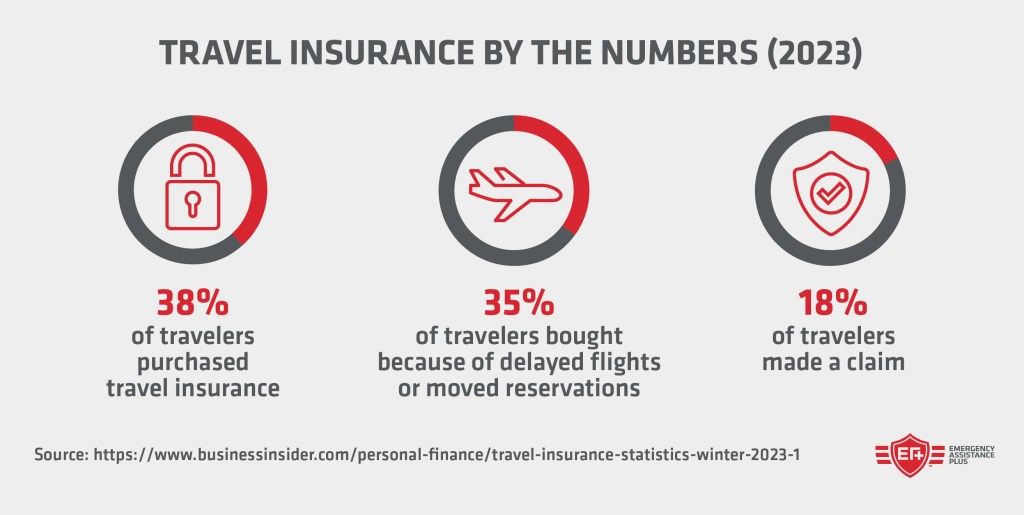

In addition to coverage options, understanding the eligibility criteria for travel insurance in the USA is important. Most travel insurance providers require travelers to purchase a policy before departing for their trip, and some may have age restrictions or pre-existing medical condition exclusions. It’s essential to carefully review the eligibility criteria of different travel insurance plans to ensure that you find the best option for your specific needs. With the right travel insurance for the USA, you can relax and focus on making unforgettable memories during your American adventure!

Comparing Different Types of Travel Insurance Plans for USA

Credits: thepointsguy.com

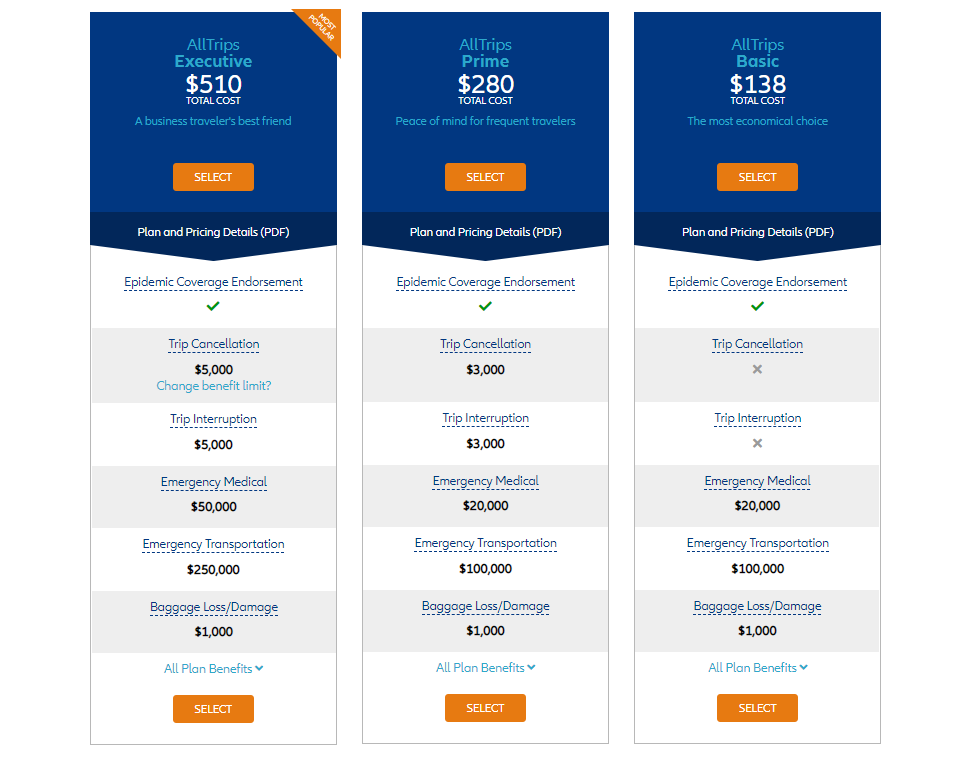

Are you planning a trip to the USA and feeling overwhelmed by the different types of travel insurance plans available? Don’t worry, we’ve got you covered! When it comes to choosing the best travel insurance for your USA travel, it’s important to consider the type of trip you’ll be taking. If you’re only planning a single trip to the USA, then a single trip insurance plan might be the best option for you. On the other hand, if you’re a frequent traveler to the USA, a multi-trip insurance plan could save you time and money in the long run. So, it’s essential to weigh the pros and cons of each type of plan to find the best fit for your travel needs.

Now, let’s talk about the coverage offered by different types of travel insurance plans for USA travel. If you’re mainly concerned about medical emergencies during your trip, then a medical insurance plan might be the most important for you. However, if you want more comprehensive coverage that includes not only medical emergencies but also trip cancellation, baggage loss, and other unexpected events, then a comprehensive insurance plan might be the way to go. It’s crucial to assess your individual needs and the potential risks of your trip to determine which type of coverage will give you the peace of mind you need while traveling in the USA.

Lastly, let’s delve into the differences between trip cancellation and trip interruption insurance plans for USA travel. Trip cancellation insurance can provide reimbursement if you have to cancel your trip before it even starts due to unexpected events such as illness, natural disasters, or other unforeseen circumstances. On the other hand, trip interruption insurance can cover the costs if you have to cut your trip short and return home due to similar unexpected events. Depending on your travel plans and personal circumstances, one type of coverage might be more valuable to you than the other. So, take the time to compare and contrast these different types of travel insurance plans for USA travel to find the best option for your next adventure.

Choosing the Right Insurance Provider for USA Travel

Credits: insuremytrip.com

When it comes to choosing the right insurance provider for your USA travel, reputation and reviews should be at the top of your checklist. Look for companies with a proven track record of providing excellent coverage and customer service. Take the time to read through customer reviews and testimonials to get a sense of the overall satisfaction level. A reputable insurance provider will have a strong online presence and positive feedback from satisfied customers. This can give you peace of mind knowing that you’re choosing a reliable and trustworthy company to protect you during your travels.

Customer service is another crucial factor to consider when selecting a travel insurance provider for your USA trip. You want to make sure that you’ll have access to assistance whenever you need it, especially in the event of an emergency. Look for companies that offer 24/7 customer support and have a reputation for being responsive and helpful. Whether you have questions about your coverage, need to make changes to your policy, or have to file a claim, having a reliable customer service team can make all the difference in your overall experience with the insurance provider.

The claim process is something that many travelers overlook when shopping for travel insurance, but it’s a critical aspect to consider. You want to choose an insurance provider that makes the claims process as smooth and straightforward as possible. Look for companies that have a streamlined online claims system and a reputation for processing claims quickly and efficiently. This can save you a lot of time and hassle in the event that you need to file a claim during your USA travels. By choosing an insurance provider with a reputation for a hassle-free claims process, you can travel with confidence knowing that you’ll be well taken care of in the event of unforeseen circumstances.

Factors to Consider When Selecting Travel Insurance for USA

Credits: awavetravel.com

When planning a trip to the USA, one of the most important things to consider is travel insurance that provides destination-specific coverage. The United States is known for its high healthcare costs, so having insurance that covers medical expenses, emergency medical evacuation, and repatriation is crucial. Make sure to carefully review the policy to ensure it includes coverage for healthcare services in the USA, as well as any specific states or cities you plan to visit. This way, you can rest assured that you will be protected in the event of any unforeseen medical emergencies during your trip.

Another key factor to consider when selecting travel insurance for the USA is coverage for pre-existing medical conditions. If you have any existing health conditions, it’s essential to disclose this information when purchasing your travel insurance. Look for a policy that offers coverage for pre-existing conditions, as well as any related medical treatment or emergencies that may arise during your trip. By doing so, you can avoid any potential issues or complications in the event that you require medical care for a pre-existing condition while in the USA.

For travelers seeking adventure during their trip to the USA, it’s important to ensure that their travel insurance offers coverage for adventure activities. Whether you plan to go hiking in national parks, skiing in the Rocky Mountains, or engaging in water sports along the coast, having insurance that includes coverage for adventurous activities can provide peace of mind. Be sure to review the policy to confirm that it covers any specific activities you plan to participate in, as well as any associated risks or potential injuries. With the right coverage in place, you can fully enjoy your adventurous pursuits in the USA, knowing that you are protected in case of any unexpected mishaps.

Tips for Getting the Most Affordable Travel Insurance for USA

When it comes to finding the most affordable travel insurance for your USA trip, comparison shopping is key. Take the time to research and compare different insurance providers to see which one offers the best coverage at the most reasonable price. Don’t settle for the first option you come across – explore your options and make an informed decision. By doing so, you can ensure that you’re getting the most bang for your buck when it comes to travel insurance.

Another tip for securing affordable travel insurance for your USA trip is to take advantage of discounts. Many insurance providers offer discounts for various reasons, such as being a student, a senior citizen, or a member of certain organizations. Be sure to inquire about any potential discounts that you may qualify for, as this can significantly lower the cost of your travel insurance. Don’t be afraid to ask questions and negotiate for the best possible deal – you may be pleasantly surprised by the savings you can achieve.

If you’re looking to keep costs down when it comes to travel insurance for your USA trip, consider opting for basic coverage. While comprehensive coverage may seem appealing, it often comes with a higher price tag. Assess your needs and determine what level of coverage is essential for your trip. By opting for a basic plan, you can ensure that you’re adequately covered for unforeseen circumstances without breaking the bank. Remember, the goal is to find affordable travel insurance that still provides the necessary protection for your USA travels.

Understanding the Fine Print of USA Travel Insurance Policies

When it comes to understanding the fine print of USA travel insurance policies, it’s important to pay close attention to the exclusions. Many policies have specific exclusions for pre-existing conditions, adventure sports, and high-risk activities. It’s crucial to review these exclusions carefully to ensure that you are covered for all of your planned activities while traveling in the USA. Additionally, some policies may have exclusions for certain destinations or regions within the USA, so it’s important to be aware of any geographical limitations as well.

In addition to exclusions, it’s essential to understand the limitations of your travel insurance policy. This includes the maximum coverage amounts for medical expenses, emergency evacuation, and trip cancellation. Some policies may have sub-limits for specific types of expenses, such as dental care or emergency medical transportation. Understanding these limitations will help you determine if the coverage provided by the policy is sufficient for your needs, or if you need to consider purchasing additional coverage or a higher coverage limit.

Finally, understanding the claim procedures outlined in your USA travel insurance policy is crucial for ensuring a smooth and hassle-free claims process. This includes knowing the required documentation for filing a claim, the time frame for submitting a claim, and the procedures for contacting the insurance company in case of an emergency. Familiarizing yourself with the claim procedures before your trip will give you peace of mind knowing that you are prepared to navigate the claims process should the need arise during your travels in the USA.

Maximizing the Benefits of Travel Insurance for USA

Credits: emergencyassistanceplus.com

When it comes to traveling to the USA, having the best travel insurance can make all the difference. From emergency medical coverage to trip cancellation protection, the right insurance plan can provide you with peace of mind and financial security during your travels. One of the key benefits of travel insurance for USA is the emergency assistance services. In the event of a medical emergency, having access to 24/7 emergency assistance can be a lifesaver. Whether you need to locate the nearest hospital or arrange for medical evacuation, a reliable travel insurance plan can connect you with the help you need, when you need it most.

In addition to emergency assistance services, travel insurance for USA also offers travel assistance services that can enhance your overall travel experience. From lost luggage assistance to travel document replacement, these services can help you navigate unexpected travel disruptions with ease. Moreover, having access to travel assistance services can save you time and stress when facing common travel mishaps. By maximizing the benefits of travel insurance for USA, you can ensure that you have the support and resources to address any travel challenges that may arise.

Furthermore, another valuable benefit of travel insurance for USA is the concierge services that are often included in comprehensive insurance plans. These services can provide you with personalized assistance in planning your trip, such as booking reservations for restaurants or arranging transportation. Whether you need recommendations for local attractions or assistance with itinerary planning, the concierge services offered by travel insurance can help you make the most of your time in the USA. By taking advantage of these services, you can elevate your travel experience and enjoy a stress-free trip, knowing that you have a dedicated support team to assist you along the way.

Ensuring Adequate Coverage with Travel Insurance for USA

Credits: issuu.com

When it comes to traveling in the USA, ensuring that you have adequate travel insurance coverage is essential. To meet the minimum coverage requirements, your travel insurance should include coverage for medical emergencies, trip cancellations, and baggage loss or delay. These are the basic necessities that will protect you from unforeseen circumstances and give you peace of mind while exploring the beautiful destinations in the USA.

In addition to the minimum coverage requirements, it’s important to consider additional coverage options that may be beneficial for your specific travel needs. For example, if you’re planning to engage in adventurous activities such as skiing or hiking, you may want to consider adding coverage for medical evacuation and adventure sports. Similarly, if you’re planning a road trip, having coverage for rental car damage or roadside assistance can be extremely helpful. By customizing your policy with these additional coverage options, you can ensure that you are fully prepared for any situation that may arise during your travels in the USA.

Fortunately, many travel insurance providers offer the flexibility to customize your policy based on your individual needs. Whether you’re traveling solo, with family, or for business purposes, you can tailor your coverage to provide the level of protection that gives you confidence and security throughout your trip. With a variety of options available, you can select the best travel insurance for USA travel that meets your specific requirements and budget, allowing you to focus on creating unforgettable memories and experiences in the diverse and captivating landscapes of the United States.

Staying Informed about Travel Insurance Regulations for USA

Credits: onshorekare.com

When it comes to traveling to the USA, staying informed about travel insurance regulations is crucial for a smooth and hassle-free trip. The legal requirements for travel insurance in the USA can vary depending on the state you plan to visit, so it’s important to do your research and ensure that you have the appropriate coverage. Whether you’re traveling for business or leisure, having the right insurance documentation can make all the difference in case of any unexpected emergencies or health issues during your trip.

In addition to legal requirements, it’s essential to stay updated on visa regulations for travel to the USA. Some visa categories may require specific types of travel insurance coverage, so it’s important to check with the US embassy or consulate in your country to understand the visa requirements for your trip. Having the right insurance documentation in line with visa regulations can also help expedite the visa application process and ensure a smooth entry into the USA without any hiccups at the border.

Before embarking on your journey to the USA, make sure to review and prepare all necessary insurance documentation. This may include proof of coverage, policy details, and emergency contact information. Keeping all your insurance documentation organized and easily accessible can save you time and stress in case of any unforeseen circumstances. By staying informed about travel insurance regulations for the USA and having the right documentation in place, you can travel with confidence and peace of mind, knowing that you’re prepared for whatever comes your way during your trip.

At wealthgists.com, we offer a range of personalized financial planning services designed to help individuals and families build and preserve their wealth. Our team of experienced financial advisors can provide expert guidance on retirement planning, investment strategies, tax optimization, and estate planning. Whether you’re just starting out in your career or preparing for retirement, our comprehensive financial services can help you achieve your long-term financial goals. With a focus on personalized solutions and a commitment to transparency, wealthgists.com is dedicated to helping our clients make informed decisions and secure their financial future.

Frequently Asked Questions

1. What is travel insurance?

Travel insurance is a type of insurance that provides coverage for unexpected events that may occur during a trip, such as trip cancellations, medical emergencies, lost luggage, and more.

2. Do I need travel insurance for travel within the USA?

While travel insurance is not mandatory for domestic travel within the USA, it can still provide valuable coverage for things like trip cancellations, medical emergencies, and other unexpected events.

3. What does travel insurance for USA travel typically cover?

Travel insurance for USA travel typically covers things like trip cancellations, emergency medical expenses, lost or delayed baggage, and travel delays due to unforeseen events.

4. Can I buy travel insurance for USA travel if I have pre-existing medical conditions?

Yes, there are travel insurance policies available that provide coverage for pre-existing medical conditions. It’s important to review the policy details and exclusions to ensure your specific needs are covered.

5. Is it worth getting travel insurance for USA travel?

Whether travel insurance is worth it for USA travel depends on your individual circumstances and the level of coverage you desire. It can provide peace of mind and financial protection in case of unexpected events during your trip.

TL;DR: When looking for the best travel insurance for USA travel, it’s important to understand the basics, compare different types of plans, and choose the right insurance provider. Consider factors such as coverage options, eligibility criteria, benefits, and destination-specific coverage. Maximize the benefits, ensure adequate coverage, and stay informed about regulations. Utilize discounts, understand the fine print, and make sure to have the necessary documentation for a smooth claim process.