Welcome to the ultimate guide to understanding your credit score! In this comprehensive guide, we will delve into the basics of credit scores, including what they are, the factors that affect them, and why they are so important. You’ll also learn how credit scores are calculated, including the components of the calculation and common misconceptions about the process. But that’s not all – we’ll also provide expert tips on how to improve your credit score, deal with negative items on your credit report, and understand the impact of credit utilization. Plus, we’ll explore the importance of monitoring and maintaining a good credit score, as well as the different credit score ranges and what they mean for loan approvals. And if you’ve ever wondered about credit score myths and facts, we’ve got you covered there too. But it doesn’t stop there – we’ll also discuss the relationship between credit score and financial planning, as well as the impact of credit score on various aspects of life, such as mortgage rates, employment opportunities, and insurance premiums. And finally, we’ll provide valuable insights on protecting your credit score from identity theft and recovering from any potential impacts. So buckle up and get ready to become a credit score expert!

Understanding the Basics of Credit Score

Credits: socom.mil

Alright, let’s dive into the exciting world of credit scores! So, what exactly is a credit score, you ask? Well, it’s a three-digit number that represents your creditworthiness. In simpler terms, it’s a way for lenders to gauge how likely you are to repay your debts. The higher your credit score, the more likely you are to be approved for loans and credit cards with favorable terms. On the other hand, a low credit score can make it challenging to secure financing or may result in higher interest rates. So, understanding your credit score is crucial for your financial well-being!

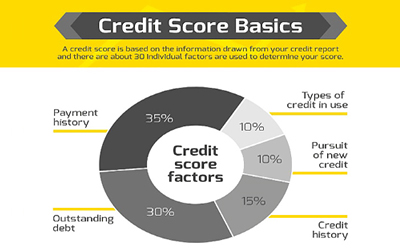

Now, let’s talk about the factors that affect your credit score. There are several key components that go into calculating your credit score, including your payment history, credit utilization, length of credit history, types of credit, and new credit inquiries. Each of these factors plays a significant role in determining your overall credit score. For example, your payment history accounts for a large portion of your credit score, so making timely payments on your debts is crucial. Similarly, keeping your credit card balances low compared to your credit limits can also improve your credit score. By understanding these factors, you can take proactive steps to improve your credit score and overall financial health.

Last but not least, let’s talk about the importance of your credit score. Your credit score can have a profound impact on various aspects of your life, from your ability to secure a mortgage or auto loan to the interest rates you’ll pay on credit cards and other loans. A good credit score can open doors to better financial opportunities, while a poor credit score can limit your options and cost you more in the long run. By understanding the importance of your credit score, you can take the necessary steps to maintain or improve it, ultimately putting yourself in a better position to achieve your financial goals.

How Credit Scores are Calculated

Have you ever wondered how exactly your credit score is calculated? It’s not as simple as just paying your bills on time. In fact, credit scores are determined by a complex algorithm that takes into account several different factors. One of the most important components of credit score calculation is your payment history. This includes whether you have paid your bills on time, the number of accounts you have that are past due, and the length of time since any past due payments. Additionally, the amount of debt you owe also plays a significant role in determining your credit score. This includes the total amount of debt you owe, the types of accounts you have, and the amount of credit you have available to you. Other factors that are taken into consideration when calculating your credit score include the length of your credit history, the types of credit you have used, and the number of new credit inquiries or accounts you have opened recently.

When it comes to credit score calculation, not all factors are created equal. Some factors are given more weight than others. For example, your payment history and the amount of debt you owe are typically given more weight than other factors, such as the length of your credit history or the types of credit you have used. This means that if you have a history of making late payments or if you have a large amount of debt, it can have a significant negative impact on your credit score. On the other hand, if you have a long history of making on-time payments and you have a low amount of debt relative to your available credit, it can have a positive impact on your credit score. It’s important to understand the weightage of different factors in credit score calculation so that you can take steps to improve your score.

There are many misconceptions about credit score calculation that can lead to confusion and misinformation. One common misconception is that checking your credit report will negatively impact your credit score. In reality, when you check your own credit report, it is considered a soft inquiry and does not affect your credit score. Another misconception is that closing old accounts will improve your credit score. In fact, closing old accounts can actually have a negative impact on your score, as it can decrease the overall length of your credit history. By understanding the common misconceptions about credit score calculation, you can ensure that you are taking the right steps to improve and maintain a healthy credit score.

Improving Your Credit Score

Credits: welchstatebank.com

Are you tired of feeling limited by your credit score? It’s time to take control and start making positive changes. One of the first steps to improving your credit score is to review your credit report for any errors. Dispute any inaccuracies and work on resolving any outstanding debts. By taking proactive steps to clean up your credit report, you can start to see improvements in your score.

Another key factor in improving your credit score is managing your credit utilization. This refers to the amount of credit you’re using compared to the amount you have available. Aim to keep your credit utilization below 30% to show lenders that you’re responsible with credit. Paying down your balances and avoiding maxing out your credit cards can have a significant impact on your score.

Dealing with negative items on your credit report can be daunting, but it’s essential for improving your credit score. Whether it’s late payments, collections, or bankruptcies, there are steps you can take to minimize their impact. Consider negotiating with creditors to settle debts, setting up payment plans, or working with credit repair professionals to help remove negative items from your report. With patience and persistence, you can take control of your credit score and set yourself up for financial success.

Monitoring and Maintaining a Good Credit Score

Maintaining a good credit score is essential for financial well-being. It not only opens up opportunities for better interest rates and loan approval but also reflects positively on your financial responsibility. That’s why regularly monitoring your credit score is crucial. By keeping a close eye on your score, you can catch any errors or signs of identity theft early on and take the necessary steps to rectify them. You can easily access your credit score through various online platforms or by requesting a copy of your credit report. Make it a habit to check your score at least once a year, if not more frequently, to ensure that it accurately reflects your credit history.

To maintain a good credit score, it’s important to practice responsible financial habits. This includes making timely payments on your credit accounts, keeping your credit card balances low, and avoiding opening too many new credit accounts at once. By consistently demonstrating these positive behaviors, you can gradually improve and maintain a healthy credit score over time. Additionally, be mindful of the impact of credit inquiries on your score. Whenever you apply for new credit, whether it’s a loan, credit card, or mortgage, it results in a hard inquiry on your credit report. Too many hard inquiries within a short period can lower your score. Therefore, it’s advisable to space out credit applications and only apply for credit when necessary.

Understanding the factors that influence your credit score is essential for effective credit score management. By familiarizing yourself with the components that make up your score, such as payment history, credit utilization, length of credit history, new credit, and credit mix, you can identify areas for improvement and take proactive steps to enhance your score. By staying informed and proactive, you can ensure that your credit score remains in good standing, opening doors to favorable financial opportunities and peace of mind.

Understanding the Different Credit Score Ranges

So, you’ve heard about credit scores, but what do they really mean? Well, let’s break it down. Credit score ranges typically fall into four categories: excellent, good, fair, and poor. An excellent credit score usually ranges from 800 to 850, while a good score falls between 670 and 800. On the other hand, a fair credit score hovers around 580 to 669, and anything below 580 is considered a poor credit score. Understanding these ranges is crucial because they can greatly impact your financial opportunities, including loan approvals, interest rates, and even job applications. Knowing where you stand within these ranges can help you strategize on how to improve your credit score and take advantage of better financial opportunities.

The credit score range you fall into can have a significant impact on your ability to secure loans and credit cards. Lenders use your credit score to assess your creditworthiness and determine the interest rates and terms they can offer you. Those with excellent credit scores generally have access to the best loan options, with lower interest rates and more favorable terms. On the other hand, individuals with poor credit scores may struggle to get approved for loans or credit cards, and when they do, they often face higher interest rates and less favorable terms. It’s important to know where you stand within these ranges so that you can take steps to improve your credit score and increase your financial opportunities.

Moving up within the credit score range is not an impossible feat. In fact, there are several strategies you can use to improve your credit score and move into a higher range. These strategies may include making timely payments, reducing your credit card balances, and disputing any errors on your credit report. Additionally, being mindful of your credit utilization ratio and avoiding opening too many new credit accounts can also positively impact your credit score. Understanding the different credit score ranges and the impact they have on your financial opportunities can empower you to take control of your credit and work towards achieving a better score.

Credit Score Myths and Facts

Credit scores are often misunderstood, and there are many myths surrounding them. One common myth is that checking your credit score will lower it. In reality, checking your own credit score is considered a “soft inquiry” and does not affect your score at all. It’s important to know the difference between a soft inquiry, which is when you check your own score, and a hard inquiry, which is when a lender checks your score when you apply for credit. Another myth is that carrying a balance on your credit cards will improve your score. In fact, it’s better to pay off your balance in full each month to show responsible credit management.

Now let’s debunk some of these credit score myths with the facts. One myth is that you need to carry a balance on your credit cards to build a good credit score. The truth is that you can actually build a good credit score by using your credit cards responsibly and paying off the balance in full each month. Another myth is that closing old accounts will improve your credit score. The reality is that closing old accounts can actually lower your score by reducing the overall length of your credit history. It’s important to understand these facts so that you can make informed decisions about your credit.

It’s important to be able to separate credit score myths from facts. One way to do this is by educating yourself about how credit scores work. By understanding the factors that influence your score and how it is calculated, you can better navigate the world of credit. It’s also important to be wary of misinformation and to seek out reliable sources when it comes to credit scores. By being informed and knowing the truth about credit scores, you can take control of your financial future and make smart decisions to improve your credit.

Credit Score and Financial Planning

Credits: wealth-mode.com

Understanding the intricacies of your credit score is an exhilarating journey that can revolutionize the way you approach financial planning. Your credit score is not just a number; it’s a powerful tool that can help you achieve your financial goals. By integrating your credit score into your financial planning, you can gain a deeper understanding of your financial health and make informed decisions that will set you up for success. Whether you’re looking to buy a home, start a business, or simply improve your financial standing, your credit score is a crucial factor that can guide you towards your objectives.

Using your credit score as a tool for financial management can be a game-changer in achieving fiscal stability. It provides valuable insights into your financial habits and highlights areas for improvement. By leveraging your credit score, you can identify patterns in your spending, saving, and borrowing behaviors, allowing you to make strategic adjustments to enhance your financial well-being. Furthermore, your credit score can serve as a benchmark for measuring your progress and success in reaching your financial milestones. With the right knowledge and strategies, you can harness the power of your credit score to steer your financial journey in the right direction.

Planning for major financial decisions based on your credit score can be both empowering and enlightening. Your credit score can influence the terms and conditions of loans, interest rates, and even your eligibility for certain financial opportunities. By understanding the impact of your credit score on these decisions, you can take proactive steps to strengthen your financial position and maximize your chances of securing favorable outcomes. Whether you’re planning to make a large purchase or embark on a new financial endeavor, your credit score can be your greatest ally in navigating the complexities of the financial landscape.

The Impact of Credit Score on Various Aspects of Life

Your credit score has a significant impact on your ability to secure favorable mortgage rates. A higher credit score often translates to lower interest rates on mortgages, which can save you thousands of dollars over the life of your loan. On the other hand, a lower credit score may result in higher interest rates, making homeownership more expensive in the long run. Understanding the relationship between credit score and mortgage rates is crucial for anyone looking to purchase a home.

In addition to mortgage rates, your credit score can also affect your employment opportunities. Many employers conduct credit checks as part of the hiring process, especially for positions that involve financial responsibilities. A poor credit score may raise red flags for potential employers, leading them to question your financial responsibility and trustworthiness. By maintaining a strong credit score, you can improve your chances of landing your dream job and advancing in your career.

Furthermore, your credit score can impact the cost of insurance premiums. Insurance companies often use credit-based insurance scores to assess the likelihood of a policyholder filing a claim. A higher credit score may result in lower insurance premiums, while a lower credit score could mean higher premiums. Understanding this correlation can motivate individuals to prioritize improving their credit score, not only for financial reasons but also for potential savings on insurance costs.

Credit Score and Identity Theft

Identity theft is a serious threat to your credit score and financial well-being. With the increasing use of technology and online transactions, it has become easier for thieves to steal personal information and use it to open fraudulent accounts or make unauthorized purchases. This can have a devastating impact on your credit score, making it difficult to obtain loans, credit cards, or even secure a mortgage. However, by taking proactive measures to protect your personal information, you can minimize the risk of identity theft and safeguard your credit score.

If you suspect that your identity has been stolen, it’s crucial to take immediate action to minimize the damage to your credit score. Start by contacting the major credit bureaus to place a fraud alert on your credit report. This will notify potential creditors to take extra steps to verify your identity before extending credit. You should also report the identity theft to the Federal Trade Commission and file a report with your local police department. By taking these steps, you can begin the process of recovering your identity and repairing any damage that has been done to your credit score.

Preventing identity theft is essential for maintaining a healthy credit score. Be cautious about sharing personal information online and regularly monitor your credit report for any suspicious activity. Consider using identity theft protection services that can help detect any unauthorized use of your personal information. Additionally, be mindful of phishing scams and only provide personal information to trusted and secure websites. By staying vigilant and proactive, you can protect your credit score from the devastating effects of identity theft.

At wealthgists.com, we offer comprehensive financial planning services to help you achieve your wealth management goals. Our team of expert advisors specializes in creating personalized investment strategies, retirement planning, and tax optimization to ensure that you are on the path to financial success. Whether you are a young professional just starting to build your wealth or a seasoned investor looking to maximize your returns, our services are tailored to meet your specific needs. With our proven track record and commitment to excellence, you can trust wealthgists.com to help you secure your financial future.

Frequently Asked Questions

1. What is a credit score?

A credit score is a numerical representation of an individual’s creditworthiness, based on their credit history and financial behavior. It is used by lenders to assess the risk of lending to a person.

2. How is a credit score calculated?

Credit scores are calculated using a variety of factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used. Each factor has a different weight in the calculation.

3. What is a good credit score?

A good credit score typically falls within the range of 670 to 850. However, the exact definition of a ‘good’ score may vary depending on the specific lender or credit scoring model being used.

4. How can I improve my credit score?

You can improve your credit score by making on-time payments, reducing debt, keeping credit card balances low, avoiding opening too many new accounts, and maintaining a long credit history.

5. Can I check my credit score for free?

Yes, you can check your credit score for free through various online platforms and credit monitoring services. It’s important to regularly monitor your credit score to stay informed about your financial health.

TL;DR: Understanding your credit score is crucial for financial stability. This ultimate guide covers the basics of credit scores, how they are calculated, and how to improve and maintain a good score. It also explains the different credit score ranges, debunks common myths, and highlights the impact of credit scores on various aspects of life, including financial planning, loan approvals, and identity theft.