Are you tired of being held back by a low credit score? Do you want to unlock better interest rates, higher credit limits, and more financial opportunities? If so, you’re in the right place. In this guide, we’ll show you how to raise your credit score fast and take control of your financial future. From understanding the factors that impact your credit score to creating a customized improvement plan, we’ve got you covered. You’ll also learn about proven strategies for boosting your credit score, maximizing its impact, and improving it through smart loan payments. Plus, we’ll dive into the art of negotiating with creditors, avoiding damaging actions, and navigating the world of credit inquiries. And if you need extra help along the way, we’ll explore the option of seeking professional assistance for credit repair. So get ready to say goodbye to a lackluster credit score and hello to a brighter financial outlook. Let’s dive in and start elevating your credit score to new heights!

Understanding Credit Scores

Credits: nfcc.org

Credit score is a three-digit number that represents your creditworthiness and is used by lenders to determine your ability to repay a loan. It is a crucial factor that affects your financial health and can impact your ability to access credit, obtain favorable interest rates, and even secure employment. Understanding your credit score is the first step towards improving it, and it’s essential to know how it is calculated and what factors influence it.

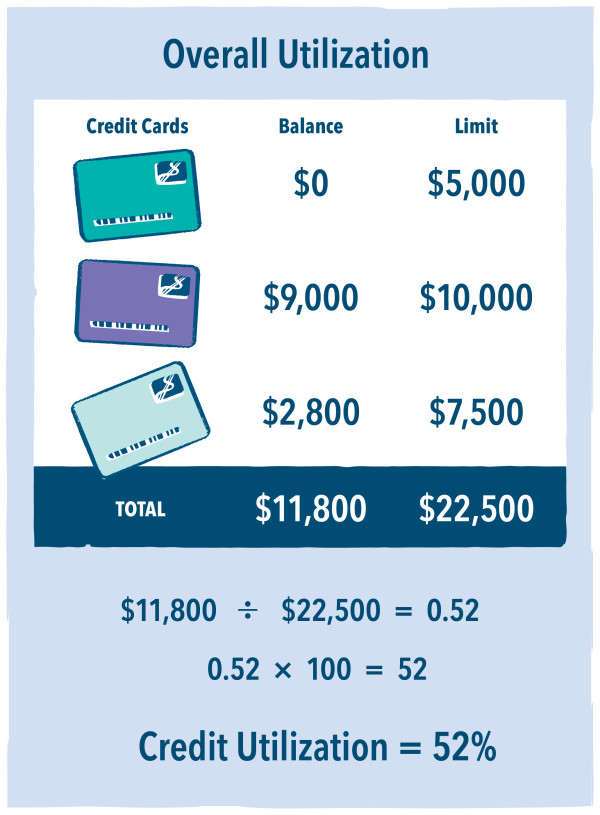

There are several factors that can affect your credit score, including payment history, credit utilization, length of credit history, new credit inquiries, and credit mix. Payment history is the most significant factor, accounting for about 35% of your credit score. This means that making timely payments on your debts can significantly boost your credit score. Credit utilization, which refers to the amount of credit you are using compared to your total available credit, also plays a crucial role in determining your credit score. It is recommended to keep your credit utilization below 30% to maintain a healthy credit score.

Your credit score is an important measure of your financial responsibility, and it can have a significant impact on your life. Whether you’re looking to buy a home, get a car loan, or even apply for a new job, having a good credit score can make the process much smoother. By understanding the factors that affect your credit score and taking proactive steps to improve it, you can raise your credit score fast and pave the way for a brighter financial future.

Creating a Credit Score Improvement Plan

Are you ready to take control of your credit score and watch it soar to new heights? Creating a credit score improvement plan is the first step toward achieving your financial goals. Start by checking your credit report for any errors that could be dragging your score down. Look for inaccuracies in your personal information, payment history, and credit utilization. By identifying and disputing these errors, you can potentially see a quick boost in your credit score.

Paying your bills on time is another crucial element of your credit score improvement plan. Late payments can have a significant negative impact on your credit score, so be sure to stay on top of all your bills. Set up automatic payments or reminders to ensure that you never miss a due date. By consistently making on-time payments, you’ll demonstrate your reliability to creditors and gradually see your credit score climb higher and higher.

Finally, reducing your credit card balances can make a big difference in improving your credit score. High credit utilization can signal to lenders that you may be overextended and high risk. Aim to keep your credit card balances below 30% of your available credit limit. By paying down your balances and avoiding maxing out your cards, you’ll show responsible credit management and see a positive impact on your credit score in no time.

Utilizing Credit Score Boosting Strategies

Are you looking to raise your credit score fast? Becoming an authorized user on someone else’s credit card can be a game-changer. By piggybacking off their responsible credit behavior, you can see a boost in your own credit score. Just make sure the primary account holder has a good credit history and pays their bills on time. This strategy can be especially helpful for young adults or those with limited credit history. It’s a quick and easy way to add positive credit history to your report.

Another effective strategy for boosting your credit score fast is applying for a secured credit card. Unlike traditional credit cards, secured cards require a security deposit as collateral. This lowers the risk for the credit card issuer, making it easier for individuals with poor or no credit to be approved. By using a secured card responsibly and making timely payments, you can demonstrate good credit habits and improve your credit score. Over time, you may even be able to upgrade to an unsecured card with a higher credit limit and better rewards.

When aiming to raise your credit score fast, it’s crucial to avoid opening new credit accounts. Each new account can temporarily lower your score due to the credit inquiry and the reduction in average account age. It’s also important to keep your credit utilization low by not maxing out your credit cards. By utilizing these credit score boosting strategies, you can see improvement in your credit score in a relatively short amount of time. Remember, patience and persistence are key when it comes to building and maintaining good credit.

Maximizing Credit Score Impact

Credits: onemainfinancial.com

Understanding your credit utilization ratio is key to maximizing your credit score impact. This ratio is the amount of credit you are currently using compared to your total available credit. A lower ratio indicates to lenders that you are not overly reliant on credit, which can boost your credit score. To improve this ratio, consider paying down your credit card balances or requesting a credit limit increase. By keeping your credit utilization ratio low, you can positively impact your credit score in a relatively short amount of time.

Another strategy to raise your credit score fast is by applying for credit limit increases. Increasing your credit limits can help lower your credit utilization ratio, as long as you continue to keep your balances low. When requesting a credit limit increase, be sure to emphasize your responsible credit usage and financial stability. Many credit card companies are willing to consider these requests, especially for customers with a history of on-time payments. By increasing your available credit, you can potentially see a quick improvement in your credit score.

Monitoring your credit score regularly is essential for anyone looking to raise their credit score fast. By keeping an eye on your credit report, you can spot any errors or issues that may be negatively impacting your score. Additionally, monitoring your credit allows you to track your progress as you work towards improving your credit score. There are many free credit monitoring services available that can help you stay on top of your credit health. By staying vigilant and proactive, you can ensure that your efforts to raise your credit score have the maximum impact in the shortest amount of time.

Improving Credit Score with Loan Payments

Are you looking to boost your credit score quickly? One effective way to do so is by making timely loan payments. Whether it’s a car loan, personal loan, or mortgage, staying on top of your payments can have a significant impact on your credit score. Lenders view timely payments as a sign of financial responsibility, which can help improve your creditworthiness. So, make sure to set up automatic payments or mark your calendar to ensure you never miss a due date. By doing so, you’ll be well on your way to seeing a positive change in your credit score.

Another option to consider is debt consolidation. If you have multiple loans with varying interest rates and due dates, consolidating them into a single loan can make it easier to manage your payments. Not only does this simplify your financial obligations, but it can also potentially lower your overall interest rate, saving you money in the long run. By effectively managing your consolidated loan payments, you’ll demonstrate to creditors that you are proactive in managing your debt, which can reflect positively on your credit score.

Additionally, exploring credit builder loans can be a game-changer when it comes to improving your credit score. These loans are specifically designed to help individuals establish or build credit. The way they work is by borrowing a small amount, usually held in a savings account or certificate of deposit, and then making regular payments over a set period. As you make these payments, the lender reports your activity to the credit bureaus, which can help demonstrate your creditworthiness. Not only can credit builder loans help raise your credit score, but they also serve as a valuable tool for learning responsible borrowing habits. So, if you’re looking to give your credit score a quick boost, consider exploring the option of credit builder loans.

Negotiating with Creditors

Negotiating with creditors can be a game-changer when it comes to improving your credit score. One effective strategy is requesting goodwill adjustments, where you explain any extenuating circumstances that may have led to a late payment and ask the creditor to remove the negative mark from your credit report. This can show lenders that you are taking responsibility for your financial situation and can help boost your credit score. Another option is negotiating settlement offers, where you work with your creditor to pay off a portion of the debt in exchange for them reporting the account as “paid in full.” This can help improve your credit score by reducing the overall amount of debt you owe. Lastly, seeking pay-for-delete agreements can also be a powerful tool. This involves offering to pay off the debt in full in exchange for the creditor removing the negative mark from your credit report, which can significantly improve your credit score.

When negotiating with creditors, it’s important to approach the situation with a positive attitude and a willingness to work together towards a solution. Be polite and professional when communicating with your creditors, and clearly explain your situation and your desire to improve your credit score. It’s also helpful to do your research and understand your rights as a consumer, as well as any potential legal options available to you. By being well-prepared and knowledgeable, you can confidently negotiate with your creditors and potentially reach a favorable outcome that will benefit your credit score.

Negotiating with creditors can be a powerful tool for quickly improving your credit score. Whether it’s requesting goodwill adjustments, negotiating settlement offers, or seeking pay-for-delete agreements, taking proactive steps to work with your creditors can lead to positive changes in your credit report. By approaching the situation with a positive attitude, being well-prepared, and effectively communicating with your creditors, you can work towards resolving any negative marks on your credit report and ultimately raise your credit score fast.

Avoiding Credit Score Damaging Actions

When it comes to raising your credit score fast, it’s crucial to avoid actions that can damage it. One common mistake is closing old credit accounts. While it may seem like a good idea to tidy up your financial accounts, closing old credit accounts can actually lower your credit score. This is because it reduces the amount of available credit you have, which can increase your credit utilization ratio. Instead of closing old accounts, consider keeping them open and using them sparingly to maintain a healthy credit history.

Another credit score damaging action to steer clear of is maxing out your credit cards. Using up the full limit on your credit cards can signal to lenders that you may be facing financial difficulties and are relying too heavily on credit. This can have a negative impact on your credit score. To raise your credit score fast, aim to keep your credit card balances well below the maximum limit. Ideally, you should aim to use no more than 30% of your available credit to maintain a healthy credit utilization ratio.

Lastly, applying for multiple new credit accounts within a short period of time can also harm your credit score. Each time you apply for new credit, a hard inquiry is made on your credit report. Too many hard inquiries can lower your credit score and signal to lenders that you may be in financial distress. To raise your credit score quickly, be mindful of how often you apply for new credit and only do so when necessary. By avoiding these credit score damaging actions, you can take proactive steps to improve your credit score and achieve your financial goals.

Understanding the Impact of Credit Inquiries

Alright, buckle up folks, because we’re diving into the world of credit inquiries! First things first, let’s talk about the difference between hard and soft credit inquiries. Hard inquiries occur when you apply for credit, such as a loan or credit card, and they can impact your credit score. On the other hand, soft inquiries, like when a potential employer checks your credit as part of a background check, do not affect your score. It’s important to be mindful of the type of inquiries being made and to limit unnecessary hard inquiries to keep your score in tip-top shape!

Now, let’s get into the nitty-gritty of how credit inquiries actually affect your score. Each hard inquiry can cause a small dip in your score, typically around 5-10 points. While this may not seem like much, multiple inquiries over a short period of time can add up and have a more significant impact. Lenders may see a high number of inquiries as a red flag, signaling that you might be taking on more debt than you can handle. So, it’s crucial to be strategic about when and how often you apply for credit to minimize the impact on your score.

So, how can we minimize unnecessary credit checks and keep our score on the up and up? First off, be selective about when you apply for credit. If you’re planning to make a big purchase, like a car or a home, try to space out your credit applications to spread out the impact on your score. Additionally, consider pre-qualifying for credit offers before submitting a formal application. This can give you a better idea of your likelihood of approval without affecting your score. By being mindful of the type and frequency of credit inquiries, you can take control of your credit score and set yourself up for financial success!

Seeking Professional Help for Credit Repair

Credits: postermywall.com

Are you tired of constantly worrying about your credit score and the impact it has on your financial future? Seeking professional help for credit repair could be the answer you’ve been looking for. Credit counseling agencies and credit repair companies specialize in helping individuals like you improve their credit scores quickly and effectively. With their expertise and experience, they can provide you with the guidance and support you need to take control of your financial situation and boost your credit score in no time.

When it comes to credit repair, many people are hesitant to seek professional help due to concerns about the potential risks and costs involved. However, it’s important to understand that working with reputable credit counseling agencies and credit repair companies can offer significant benefits. These professionals have the knowledge and resources to navigate the complex world of credit reporting and can help you identify and address any inaccuracies or issues on your credit report. By enlisting their help, you can take proactive steps to improve your credit score and regain financial stability.

In addition to the tangible benefits of working with credit repair professionals, there’s also the peace of mind that comes with knowing you’re not alone in your credit repair journey. These experts are dedicated to advocating for your best interests and can provide personalized advice and solutions tailored to your unique financial situation. By taking the proactive step of seeking professional help for credit repair, you can finally break free from the burden of a low credit score and move forward with confidence in your financial future.

Wealthgists.com offers a range of valuable services and products for individuals looking to improve their financial well-being. Our expertly crafted content covers a wide variety of topics including personal finance, investment strategies, wealth management, and financial planning. Whether you are a seasoned investor or just starting to build your wealth, our comprehensive resources provide valuable insights and actionable advice to help you reach your financial goals. With wealthgists.com, you can access the tools and information you need to make informed decisions and take control of your financial future.

Frequently Asked Questions

1. What are some ways to quickly raise my credit score?

Some ways to quickly raise your credit score include paying off any outstanding debts, lowering your credit utilization ratio, and disputing any errors on your credit report.

2. How long does it take to see an increase in my credit score?

The time it takes to see an increase in your credit score can vary depending on the actions you take, but generally, you may start to see improvements within a few months.

3. Is it possible to raise my credit score by a significant amount in a short period of time?

While it may be challenging to raise your credit score by a significant amount in a short period of time, taking proactive steps to improve your credit habits can lead to noticeable improvements.

4. Will applying for new credit cards or loans help raise my credit score?

Applying for new credit cards or loans can temporarily lower your credit score due to hard inquiries, so it’s important to carefully consider whether the potential benefits outweigh the potential drawbacks.

5. How can I maintain a good credit score once I’ve raised it?

To maintain a good credit score, it’s important to continue practicing good credit habits, such as paying bills on time, keeping credit card balances low, and monitoring your credit report for any errors.

TL;DR: To raise your credit score fast, understand what a credit score is and how it’s calculated. Create a plan to improve your score, utilize strategies like becoming an authorized user and applying for a secured credit card, and maximize the impact of your credit score. Make timely loan payments, negotiate with creditors, and avoid actions that can damage your score. Understand the impact of credit inquiries and seek professional help if needed.