Are you ready to take charge of your financial health? Understanding and monitoring your credit score is a crucial step in achieving your financial goals. From free methods to paid options, there are various ways to check your credit score in the USA. In this blog, we will explore the top methods for checking your credit score, including understanding the basics of credit scoring, free and paid options for checking your score, the impact of credit score on credit applications, monitoring for identity theft, understanding credit score fluctuations, comparing your score with peers, setting financial goals based on your credit score, and accessing resources and tools to help you on your credit score journey. Whether you’re looking to improve your credit score, apply for a loan, or simply stay on top of your financial well-being, knowing how to check and understand your credit score is essential. So let’s dive in and discover the best methods for checking your credit score in the USA!

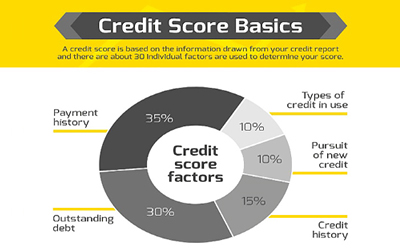

Understanding Credit Score Basics

Credits: socom.mil

Your credit score is one of the most important numbers in your financial life. It’s a three-digit number that represents your creditworthiness and is used by lenders to determine whether or not to approve you for credit. A good credit score can open doors to lower interest rates on loans, better credit card offers, and more. On the other hand, a poor credit score can make it difficult to qualify for loans and may result in higher interest rates. Understanding the basics of credit score is crucial for maintaining a healthy financial life.

There are several factors that can affect your credit score. Payment history, which includes whether you’ve paid your bills on time, makes up the largest portion of your credit score. The amount of debt you owe, the length of your credit history, new credit accounts, and the types of credit you have also play a role in determining your credit score. By understanding these factors, you can take steps to improve your credit score and maintain a good credit standing.

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. While the exact credit score ranges can vary slightly depending on the credit scoring model used, generally, a score above 700 is considered good, while a score below 600 is considered poor. It’s important to regularly check your credit score to ensure that it accurately reflects your credit history and to monitor for any potential signs of identity theft or fraud. By understanding the basics of credit score and how it’s calculated, you can take control of your financial future and make informed decisions about your credit.

Free Methods for Checking Credit Score

Gone are the days of having to pay to access your credit score. With the advancement of technology, there are now several free methods available for checking your credit score in the USA. One of the most reliable ways to obtain your credit score for free is by visiting the official websites of the major credit bureaus. These websites typically allow you to access your credit score and credit report once a year, giving you the opportunity to review your financial standing without any cost.

Another convenient way to check your credit score for free is by simply reviewing your credit card statement or logging into your online account. Many credit card companies now provide their customers with access to their credit scores as part of their online services. This makes it incredibly easy to keep tabs on your credit score without having to go through a separate process or sign up for additional services.

If you’re looking for a more proactive approach to monitoring your credit score, you may want to consider using a credit monitoring service. There are several reputable companies that offer free credit monitoring, which not only provides you with access to your credit score but also sends alerts for any changes or potential fraud. This can be a valuable tool for staying on top of your credit health and making sure everything is in order.

Paid Options for Checking Credit Score

When it comes to checking your credit score in the USA, there are several paid options available for you to choose from. One popular method is to sign up for a credit score subscription service. These services provide you with regular updates on your credit score, as well as detailed insights into the factors that are impacting your score. With a subscription, you can easily monitor any changes to your credit report and stay on top of your financial health.

Another option for checking your credit score is to make a one-time purchase. Many credit reporting agencies and financial websites offer the option to buy your credit score for a one-time fee. This can be a convenient choice if you only need to check your score occasionally, and don’t want to commit to a monthly subscription. Keep in mind that the cost of a one-time credit score purchase can vary depending on the provider, so be sure to shop around for the best deal.

Finally, some financial products include access to your credit score as a perk. For example, certain credit cards and banking accounts provide customers with free access to their credit score as part of the account benefits. If you’re already in the market for a new financial product, such as a credit card or loan, this can be a great way to check your credit score without any additional cost. Be sure to read the fine print to understand exactly what credit monitoring services are included with the product.

Checking Credit Score Impact on Credit Applications

Credits: self.inc

We all know that our credit score plays a significant role in our ability to secure credit, but have you ever wondered exactly how it impacts your credit applications? When you apply for credit, the lender will typically pull your credit report to assess your creditworthiness. This results in what is known as a hard inquiry, and it can have a temporary negative impact on your credit score. The good news is that the impact is usually minimal, and as long as you’re not applying for credit excessively, it should not significantly harm your score.

Your credit score also plays a crucial role in determining the terms and conditions of the credit you’re applying for. For example, if you’re looking to secure a mortgage, you’ll generally need a higher credit score than if you were applying for a personal loan. lenders use your credit score to gauge the level of risk they’re taking on by lending to you, so the higher your score, the more favorable terms you’re likely to receive. If you have a lower credit score, you may still be able to secure credit, but you may face higher interest rates and less favorable repayment terms.

If you’re concerned about the impact of your credit score on your credit applications, there are steps you can take to improve it. Paying your bills on time, keeping your credit card balances low, and avoiding opening multiple new accounts in a short period can all help boost your credit score. By taking proactive steps to improve your credit, you can increase your chances of securing credit with favorable terms and conditions, giving you greater financial flexibility and peace of mind.

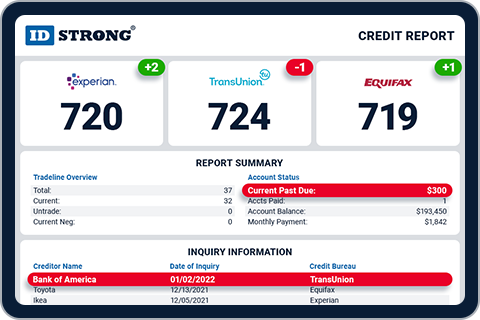

Monitoring Credit Score for Identity Theft

Credits: idstrong.com

Keeping a close eye on your credit score is not just about maintaining a good financial standing; it’s also an essential tool for detecting potential identity theft. Your credit report can reveal signs of fraudulent activity, such as unfamiliar accounts or inquiries. By regularly monitoring your credit score, you can catch these red flags early on and take the necessary steps to protect yourself from further harm.

If you suspect that you may be a victim of identity theft, it’s crucial to act quickly. Contact the credit bureaus to place a fraud alert on your credit report, which will make it more difficult for unauthorized individuals to open new accounts in your name. You should also file a report with the Federal Trade Commission and consider placing a credit freeze on your accounts to prevent any further damage. By staying vigilant and taking swift action, you can minimize the impact of identity theft on your finances.

One of the most effective ways to stay on top of your credit score and detect any suspicious activity is by using a credit monitoring service. These services can provide real-time alerts for any changes to your credit report, such as new accounts being opened or large transactions taking place. By leveraging the power of technology, you can have peace of mind knowing that your credit score is being actively monitored for any signs of identity theft.

Understanding Credit Score Fluctuations

Do you ever wonder why your credit score seems to fluctuate so frequently? Well, there are a multitude of factors that can cause your credit score to change. One of the most common factors is your payment history. Late payments, missed payments, or even just making the minimum payment can all have an impact on your credit score. Additionally, the amount of debt you owe and the length of your credit history can also play a role in credit score fluctuations. It’s important to understand that these fluctuations are normal and can happen as frequently as every 30 days.

Many people are surprised to learn that their credit score can update as often as every 30 days. This means that any changes in your credit behavior, such as paying off a credit card or applying for a new loan, can have an immediate impact on your credit score. It’s important to stay on top of your credit report and be aware of any changes that could affect your score. By regularly checking your credit score, you can stay informed about any fluctuations and take steps to improve your credit over time.

Your credit behavior has a direct impact on the fluctuations of your credit score. By making on-time payments, keeping your credit card balances low, and avoiding opening multiple new accounts at once, you can help maintain a healthy credit score. It’s important to be mindful of your credit behavior and the potential impact it can have on your credit score. By understanding the factors that cause fluctuations and taking proactive steps to improve your credit, you can work towards achieving a more stable and positive credit score.

Credit Score Comparison with Peers

Comparing your credit score with your peers can be an exciting and insightful way to gauge where you stand in the financial game. By understanding the average credit scores of people in your age group, location, or income bracket, you can gain valuable perspective on how your credit score measures up. It’s like a friendly competition where you can strive to improve and surpass the average, giving you a sense of accomplishment and financial empowerment.

Furthermore, benchmarking your credit score against your peers can also motivate you to take steps to improve your credit health. If you find that your credit score is below the average for your demographic, it can serve as a wake-up call to start making positive changes to your financial habits. Whether it’s paying off debts, lowering credit card balances, or making timely bill payments, the comparison with your peers can serve as a catalyst for positive financial behavior.

Finally, improving your credit score compared to your peers can have long-term benefits. A higher credit score not only opens up more opportunities for loans and credit, but it also reflects positively on your financial responsibility. As you work towards surpassing the average credit score of your peers, you’ll be setting yourself up for a more secure financial future. With determination and the right financial habits, you can elevate your credit score above the average, giving you a sense of achievement and pride in your financial journey.

Credit Score and Financial Goal Setting

Setting goals for improving your credit score can be an exciting and empowering process. Whether you’re looking to buy a home, get a new car, or simply want to have better financial options available to you, having a clear credit score improvement goal in mind can help you stay motivated and focused. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals for your credit score, you can track your progress and celebrate your achievements along the way. This can make the journey to a better credit score feel like an exciting adventure rather than a daunting task.

Using your credit score as a tool for financial planning can be an exciting way to take control of your financial future. Your credit score can affect everything from the interest rates you’re offered on loans to the insurance premiums you pay, so understanding how your credit score impacts your financial options can be empowering. By setting financial goals that are directly tied to improving your credit score, you can create a clear roadmap for achieving your long-term financial aspirations. Whether it’s saving for retirement, starting a business, or simply building a more secure financial foundation, having a solid credit score can be a key factor in reaching your financial goals.

When it comes to making financial decisions, having a clear understanding of your credit score can be an exciting way to take control of your financial future. Whether you’re considering taking out a loan, applying for a credit card, or even renting an apartment, your credit score can play a significant role in the opportunities that are available to you. By setting a goal to improve your credit score, you can open up new possibilities for your financial future and make more informed decisions about how to manage your money. This can make the process of building and maintaining a good credit score feel like an exciting journey toward greater financial freedom and security.

Credit Score Resources and Tools

There are countless credit score apps and websites available to help you easily check your credit score in the USA. These tools provide a convenient way to monitor your credit standing and keep track of any changes. With just a few clicks, you can access your credit score and even receive personalized tips for improving it. Some apps even offer credit monitoring services, sending you alerts for any significant changes to your score. Whether you prefer a mobile app or a desktop website, there are plenty of options to choose from to stay on top of your credit.

In addition to credit score apps and websites, there are also educational resources available to help you better understand your credit score. These resources offer valuable information on what factors contribute to your score, how it is calculated, and what you can do to improve it. Some of these resources even provide interactive tools and simulators to help you see how different financial decisions can impact your credit score. By taking advantage of these educational resources, you can gain a deeper understanding of your credit and make more informed decisions about your finances.

Furthermore, there are tools specifically designed to help you track and improve your credit score. These tools often come with features such as credit score simulators, credit report monitoring, and personalized recommendations for boosting your score. By regularly using these tools, you can stay proactive about managing your credit and take the necessary steps to improve it. With the right tools at your disposal, you can work towards achieving a healthy credit score and gaining greater financial freedom.

At wealthgists.com, we specialize in providing expert financial advice and wealth management services tailored to individuals and businesses looking to grow their wealth. Our team of experienced professionals offers a wide range of services including investment management, retirement planning, tax optimization, and risk management. We understand the unique financial needs of our clients and work diligently to create personalized strategies that align with their long-term goals. Whether you are a seasoned investor or just starting to build your wealth, wealthgists.com has the expertise and resources to help you achieve financial success.

Frequently Asked Questions

1. How often should I check my credit score?

It is recommended to check your credit score at least once a year to monitor for any changes or discrepancies.

2. What is the best method for checking my credit score?

The best method for checking your credit score is to use a reputable credit monitoring service or obtain a free credit report from one of the three major credit bureaus.

3. Will checking my credit score affect my credit?

No, checking your own credit score will not affect your credit. This type of inquiry is considered a soft inquiry and does not impact your credit score.

4. What factors can negatively affect my credit score?

Factors such as late payments, high credit utilization, and derogatory marks can have a negative impact on your credit score.

5. How can I improve my credit score?

To improve your credit score, focus on making on-time payments, reducing credit card balances, and addressing any negative items on your credit report.

TL;DR: Understanding and monitoring your credit score is essential for financial health. You can check it for free through official credit bureaus’ websites or through credit card statements. Paid options include credit monitoring services and one-time purchases. Your credit score impacts loan approvals and interest rates, and can also signal identity theft. Understanding fluctuations and comparing with peers can help set improvement goals. Numerous resources and tools are available to help you track and improve your credit score.