Welcome to the future of investment platforms in 2024! As technology continues to revolutionize the financial industry, investment platforms are evolving to offer more user-friendly interfaces, advanced security measures, and a wider range of investment options. In this dynamic landscape, it’s crucial to stay informed about the top investment platforms that are leading the way in innovation and customer service. From the integration of AI and blockchain technology to the growing demand for sustainable investing options, the investment platform industry is experiencing unprecedented growth and change. Join us as we explore the key features of the top investment platforms, the impact of global economic trends, and the emerging regulatory changes affecting the industry. Get ready to discover the exciting future of investment platforms and the opportunities they hold for investors in 2024!

Overview of Investment Platforms in 2024

The year 2024 is set to be an exciting time for investment platforms, as we witness a rapid evolution in their features and capabilities. The top investment platforms are incorporating cutting-edge technologies such as artificial intelligence and machine learning to provide users with more personalized and efficient investment experiences. With these advancements, investors can expect a more seamless and intuitive platform that caters to their specific needs and preferences. Additionally, the integration of blockchain technology is revolutionizing the way investment platforms handle security and transparency, offering users greater peace of mind when managing their investments.

In 2024, investment platforms are not just about facilitating transactions; they are becoming comprehensive financial management tools. From automated portfolio management to advanced risk assessment algorithms, these platforms are empowering users to make informed investment decisions. Moreover, the integration of social networking features within investment platforms is fostering a sense of community and collaboration among users. Investors can now engage in discussions, share insights, and learn from each other, creating a dynamic and interactive environment that goes beyond traditional investment platforms.

The impact of technology on investment platforms in 2024 is undeniable, as we witness a shift towards more user-centric and innovative solutions. From customizable dashboards to personalized investment recommendations, these platforms are leveraging big data and analytics to deliver unparalleled value to their users. Additionally, the rise of robo-advisors and automated investment tools is democratizing access to investment opportunities, making it easier for individuals to grow their wealth. As we look ahead to 2024, it’s clear that investment platforms will continue to play a pivotal role in shaping the future of finance, offering users a seamless and empowering investment experience.

Comparison of the Best Investment Platforms

Credits: medium.com

2024 is shaping up to be an exciting year for investment platforms, with several top contenders vying for the spotlight. As investors seek more user-friendly and intuitive interfaces, the competition is fierce as platforms strive to offer the best user experience. From streamlined navigation to customizable dashboards, the leading investment platforms are pulling out all the stops to attract and retain users. It’s truly an exhilarating time for investors as they witness the evolution of investment platforms into sleek, modern, and user-centric interfaces.

When it comes to investment options and flexibility, the top platforms are raising the bar higher than ever. From traditional stocks and bonds to alternative investments like real estate and cryptocurrencies, investors have a plethora of options at their fingertips. The best investment platforms are not only expanding their range of investment options but also enhancing the flexibility and control that users have over their portfolios. Whether it’s automated investing, customizable portfolios, or fractional shares, these platforms are empowering investors to tailor their investment strategies to their unique preferences and goals, making 2024 an exciting year for investment opportunities.

In the realm of security measures and customer support, the leading investment platforms are leaving no stone unturned. With the increasing focus on cybersecurity and data protection, investors can rest assured that their assets and personal information are in safe hands. Moreover, customer support has become a key differentiator among investment platforms, with top contenders offering round-the-clock support, comprehensive educational resources, and personalized guidance. As the competition heats up, investors can look forward to being treated to top-notch security and support services, making the investment journey in 2024 a truly thrilling experience.

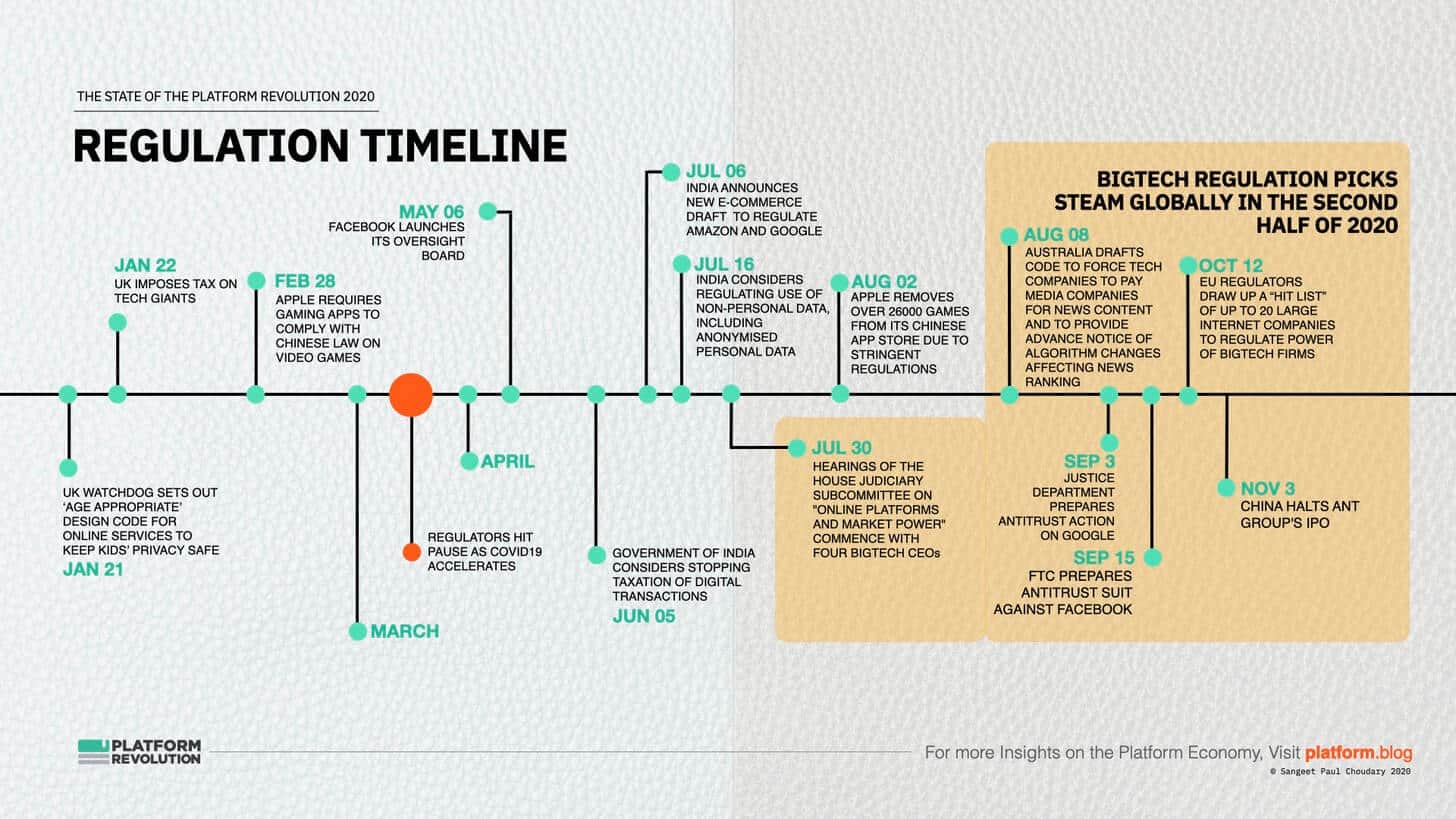

Regulatory Changes Affecting Investment Platforms

Credits: platformthinkinglabs.com

2024 is set to bring about significant regulatory changes that will directly impact investment platforms. With new laws and policies on the horizon, the landscape for investment platforms is evolving rapidly. From compliance requirements to government regulations, the investment platform industry is facing a wave of change that will undoubtedly shape the way users interact with these platforms.

One of the key areas of focus for regulatory changes in 2024 is the compliance requirements for investment platforms. As governments seek to enhance transparency and security within the financial sector, investment platforms are being held to higher standards. This means that users can expect to see improved safeguards in place to protect their investments, as well as greater accountability from platform operators. These changes are aimed at creating a more trustworthy and secure environment for investors to engage with, ultimately benefiting the industry as a whole.

The impact of these regulatory changes on investment platform users cannot be overstated. As governments implement new laws and policies, users can anticipate a more regulated and secure investment experience. While these changes may require some adjustment for both platform operators and users, they ultimately serve to strengthen the investment platform industry, providing a more reliable and transparent environment for investors. By staying informed about these regulatory changes, users can make more informed decisions about their investments and have greater confidence in the platforms they choose to engage with.

Emerging Trends in Investment Platform Technology

The integration of AI and machine learning in investment platforms is revolutionizing the way investors make decisions. With the power of AI, these platforms can analyze vast amounts of data to identify patterns and trends, helping investors make more informed choices. This technology also enables personalized investment recommendations based on individual risk tolerance and financial goals, making the investment process more efficient and effective.

Blockchain technology is also making waves in the investment platform industry. By leveraging blockchain’s decentralized and secure nature, investment platforms can offer greater transparency and security to investors. Smart contracts on the blockchain also enable automated and trustless transactions, reducing the need for intermediaries and streamlining the investment process. As blockchain continues to mature, we can expect to see even more innovative applications in investment platforms, further enhancing the investor experience.

Looking ahead, the future of investment platform technology is incredibly exciting. With the rapid pace of technological advancement, we can anticipate even more sophisticated AI capabilities, seamless integration with blockchain, and enhanced user interfaces. These developments will not only make investing more accessible to a wider audience but also empower investors with powerful tools and insights. As we approach 2024, the investment platform landscape is poised for unprecedented innovation and growth, and investors can look forward to an increasingly dynamic and rewarding investment experience.

Risk Management Strategies for Investment Platforms

In the fast-paced world of investment platforms, risk management is a crucial aspect that cannot be overlooked. As the landscape of investment opportunities continues to evolve, it is essential for platforms to assess and mitigate risks effectively. This includes identifying potential threats to the platform’s operations, such as cybersecurity breaches, market volatility, and regulatory changes. By implementing robust risk management strategies, investment platforms can safeguard the interests of their investors and maintain a secure environment for financial transactions.

One of the primary concerns in risk management for investment platforms is ensuring the security of investor funds. With the increasing prevalence of online investment platforms, it is imperative to address the potential risks associated with digital transactions. This involves implementing advanced security measures to protect sensitive financial information and prevent unauthorized access to investor accounts. By prioritizing the security of investor funds, platforms can build trust and credibility among their user base, ultimately attracting more investors and driving growth in the platform’s operations.

Regulatory compliance is also a key component of risk management for investment platforms. As the financial industry continues to be subject to evolving regulations and compliance standards, platforms must stay abreast of these changes to mitigate potential risks. By adhering to regulatory requirements, investment platforms can demonstrate their commitment to ethical and transparent business practices, thereby reducing the risk of legal and financial repercussions. Additionally, maintaining regulatory compliance can help investment platforms build a positive reputation in the industry, attracting more investors and fostering long-term success.

The Role of Cybersecurity in Investment Platforms

The year 2024 brings with it a new set of challenges for investment platforms, particularly in the realm of cybersecurity. As the digital landscape continues to evolve, so do the threats facing investment platforms. From sophisticated hacking techniques to ransomware attacks, the stakes are higher than ever. However, with the right cybersecurity measures in place, investment platforms can stay ahead of the curve and protect their investors’ data and assets.

In the investment industry, cybersecurity is not just a matter of compliance; it’s a critical component of maintaining trust and confidence among investors. Best practices for cybersecurity in investment platforms include implementing robust encryption methods, multi-factor authentication, and regular security audits. By staying proactive and vigilant, investment platforms can minimize the risk of cyber attacks and ensure the safety of their investors’ sensitive information.

Protecting investor data and assets from cyber attacks is paramount in 2024. Investment platforms must invest in cutting-edge cybersecurity technologies and stay informed about the latest cyber threats and trends. By fostering a culture of cybersecurity awareness and prioritizing the protection of investor data, investment platforms can navigate the digital landscape with confidence and resilience.

Impact of Global Economic Trends on Investment Platforms

The impact of global economic trends on investment platforms in 2024 is nothing short of thrilling. Geopolitical factors are playing a significant role in influencing the performance of these platforms. As countries navigate through trade agreements, diplomatic relations, and international conflicts, investment platforms are experiencing the ripple effects. This dynamic environment creates opportunities for investors to capitalize on emerging markets and industries that are influenced by these geopolitical factors. With the right strategies and insights, investors can ride the wave of these global economic trends and maximize their returns on investment platforms.

Market volatility in 2024 is also shaping the landscape of investment platforms. The ever-changing market conditions are keeping investors on their toes, but this presents a thrilling challenge for those who thrive in the fast-paced world of investments. As traditional markets fluctuate, alternative investment platforms have gained traction, offering unique opportunities for investors to diversify their portfolios. The ability to adapt and pivot in response to market volatility is crucial, and investment platforms are rising to the occasion by providing innovative solutions and tools for investors to navigate through these turbulent times.

adapting investment strategies to changing global economic conditions is key for investors looking to thrive in 2024. Investment platforms are evolving to meet the demands of a dynamic global economy, offering a wide range of investment products and services to cater to different risk appetites and investment goals. Whether it’s sustainable investing, fintech innovations, or real estate opportunities, investment platforms are at the forefront of providing diverse options for investors to capitalize on the changing economic landscape. Investors who embrace these changes and stay informed about global economic trends will be well-positioned to make the most of the exciting opportunities that lie ahead.

The Future of Sustainable Investing on Platforms

The future of sustainable investing on platforms is looking brighter than ever as trends in socially responsible investing continue to gain traction. More and more investors are seeking out opportunities to align their financial goals with their values, and investment platforms are taking notice. In 2024, we can expect to see a significant increase in the integration of environmental, social, and governance (ESG) factors into the offerings of these platforms, providing investors with a wide range of sustainable investment options to choose from.

One of the most exciting developments in the world of sustainable investing is the growing demand for ESG-focused investment products. As awareness of climate change, social justice issues, and corporate governance practices continues to spread, investors are increasingly seeking out investment opportunities that not only offer financial returns, but also make a positive impact on the world. This shift in investor preferences is driving the expansion of sustainable investment options on platforms, with a wide variety of ESG-focused funds, ETFs, and individual stocks becoming more readily available to investors of all sizes.

In addition to the increasing availability of sustainable investment options, investment platforms are also expected to enhance their educational resources and tools related to sustainable investing. As more investors express interest in ESG factors and sustainable investment strategies, platforms will likely respond by providing comprehensive educational materials, research reports, and screening tools to help investors make informed decisions about their sustainable investment choices. This focus on education and transparency will empower investors to make a positive impact through their investment decisions, ultimately driving further growth in the sustainable investing space.

Innovations in Customer Service for Investment Platforms

Get ready for an exciting wave of innovations in customer service for investment platforms in 2024! Gone are the days of waiting on hold for a customer service representative – the future is all about chatbots and AI. Investment platforms are increasingly incorporating chatbots and AI into their customer support systems, allowing for quicker response times and more efficient problem-solving. These advanced technologies are revolutionizing the way investors interact with their platforms, providing a seamless and hassle-free customer experience.

But that’s not all – the personalization and customization of investor services are also taking center stage in 2024. Investment platforms are now offering tailored services based on individual investor preferences and goals. Whether it’s creating a personalized investment portfolio or receiving targeted financial advice, investors can expect a higher level of customization than ever before. This shift towards personalized services is empowering investors to take greater control of their financial futures, ultimately leading to more satisfied and engaged users.

And let’s not forget about the user experience – investment platforms are continuously striving to improve their customer service by implementing innovative solutions. From intuitive user interfaces to proactive customer support, platforms are focusing on enhancing the overall user experience. By prioritizing user-centric design and functionality, investment platforms are setting the stage for a new era of customer service that is both efficient and user-friendly. So buckle up and get ready to experience the future of customer service in the world of investment platforms!

At wealthgists.com, we specialize in providing expert financial advice and investment strategies for individuals looking to build and grow their wealth. Our team of experienced professionals offers a range of services including personalized financial planning, investment management, and retirement strategies tailored to each client’s unique goals and needs. Whether you’re just starting to build your wealth or looking to maximize your current investments, wealthgists.com has the expertise and resources to help you achieve financial success. With our proven track record and dedication to client satisfaction, we are committed to helping you make informed decisions and secure your financial future.

Frequently Asked Questions

1. What are the key features to look for in an investment platform?

When evaluating investment platforms, it’s important to consider factors such as user interface, investment options, fees, customer service, and security measures.

2. How can I determine if an investment platform is trustworthy?

You can assess the trustworthiness of an investment platform by researching its regulatory compliance, reading user reviews, and checking for any history of security breaches or fraudulent activity.

3. What are some popular investment platforms that have shown promising growth potential?

Several investment platforms, such as Robinhood, Acorns, Wealthfront, and Betterment, have demonstrated significant growth potential and are worth keeping an eye on in 2024.

4. How do I know if an investment platform aligns with my investment goals and risk tolerance?

Before choosing an investment platform, it’s essential to evaluate its investment options, risk management tools, and suitability for your specific investment objectives and risk tolerance.

5. What are the potential risks associated with using investment platforms?

Some potential risks of using investment platforms include market volatility, loss of investment capital, technical glitches, and cybersecurity threats. It’s important to be aware of these risks and take necessary precautions.

TL;DR: The investment platform industry in 2024 is seeing rapid evolution and innovation, with an emphasis on advanced technology, regulatory compliance, risk management, and customer service. Key features, user experience, and investment options are critical factors, along with security measures and support. Government regulations, AI, machine learning, and blockchain technology are shaping the future of investment platforms. Additionally, the impact of global economic trends, sustainable investing, and advancements in customer service are key areas to watch out for in 2024.