TWINO is a European peer-to-peer lending platform that connects investors with borrowers, offering investment opportunities in various financial instruments. In this comprehensive review, we will explore the platform’s features, investment opportunities, risks, and performance.

TWINO is a platform that allows investors to invest in business loans issued to Loan Originators in different countries. The platform has been known to provide fixed returns, with projected annual returns of up to 12%. However, it’s essential to understand the risks associated with investing in TWINO and consider alternative investment options.

How TWINO Works

Key Numbers and Statistics

TWINO has experienced significant growth in recent years, with a total investment volume of €1.2 billion in 2022. The platform has also expanded its presence in various countries, including Poland, Spain, and Romania.

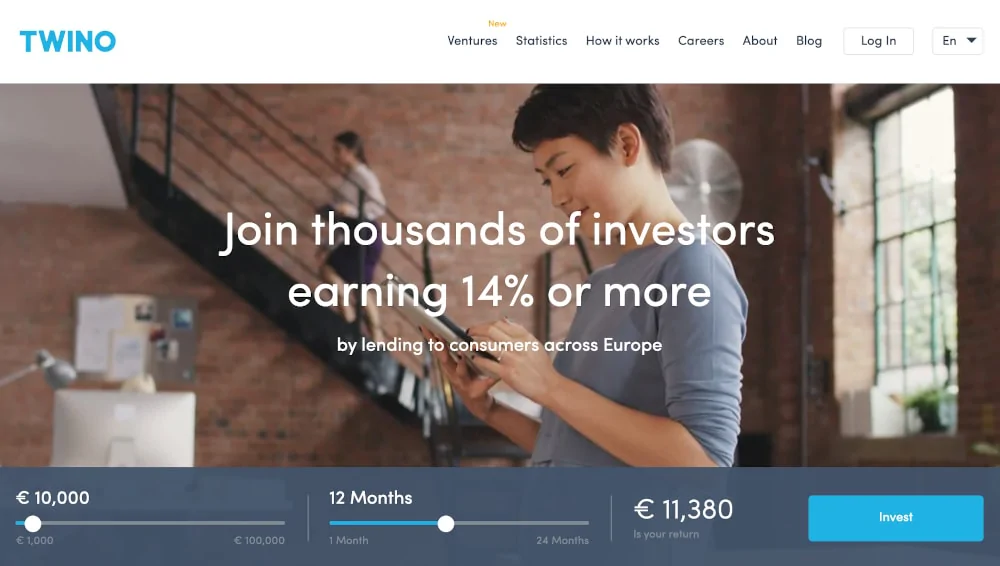

Twino’s Investment Minimum

The minimum investment amount for TWINO varies depending on the type of investment instrument. For real estate securities, the minimum investment amount is €100. For loan securities, the minimum investment amount is equal to the nominal amount of one security, which is €1 by default but may change during principal repayments. TWINO’s investment platform is accessible to individual investors who are at least 18 years old and citizens and residents of a European Economic Area country. Legal entities registered in Latvia can also invest on the platform. TWINO provides free investment services to its clients and receives a commission from issuers of financial instruments with which TWINO and loan originators cooperate.

Transparency and Financial Information

TWINO’s financial information and transparency have been criticized in the past, which may raise concerns about the safety of funds. The platform has faced challenges related to its Russian portfolio, which has become illiquid due to regulations.

Investment Opportunities

Types of Financial Instruments Offered

TWINO offers various financial instruments, including business loans issued to Loan Originators in different countries. Investors can choose from different investment options based on their risk tolerance and investment goals.

Projected Returns and Risks

TWINO’s risk management strategy aims to ensure effective overall risk mitigation, but the value of investments could decline due to any of the risks mentioned. The platform’s risk profile has changed, and as of 2024, it is considered suitable only for risk-friendly investors due to its exposure to high-risk lending portfolios.

Investor Profile

TWINO’s investment opportunities are suitable for risk-friendly investors who are willing to accept higher risks for potentially higher returns.

Risks Associated with TWINO Investment

Credit Default Risk

Securities are backed by the underlying loan portfolio, and investors are subject to the risk of credit default, which may result in a loss of their investment.

Repayment Risk

TWINO’s risk management strategy aims to ensure effective overall risk mitigation, but the value of investments could decline due to any of the risks mentioned.

High-Risk Lending Portfolio

TWINO is now considered suitable only for risk-friendly investors due to its exposure to high-risk lending portfolios.

Regulatory and Geopolitical Risks

TWINO has faced challenges related to its Russian portfolio, which has become illiquid due to regulations. The platform’s financial information and transparency have been criticized in the past, which may raise concerns about the safety of funds.

TWINO’s Performance and Challenges

Company Management and Structural Changes

TWINO has experienced significant changes in its management and structure, which may impact its performance and risk profile.

Financial Performance and Transparency

TWINO’s financial performance has been affected by its Russian portfolio, which has become illiquid due to regulations. The platform has faced challenges related to its financial information and transparency.

Challenges and Opportunities

TWINO has experienced difficulties in its expansion strategy, which has led to delays in publishing consolidated financial information. The platform’s performance and challenges should be carefully considered by potential investors.

Conclusion

In conclusion, TWINO offers investment opportunities in various financial instruments, but it comes with significant risks. The platform’s risk profile has changed, and it is now considered suitable only for risk-friendly investors. Potential investors should carefully consider these risks and explore alternative investment options before making a decision. Start your investment journey now