Welcome to the ultimate guide on understanding USA travel insurance coverage! Whether you’re planning a quick weekend getaway or a long-term trip, having the right insurance plan in place is crucial for your peace of mind. In this comprehensive blog series, we will delve into the basics of travel insurance coverage, including the different types of coverage available, the requirements for obtaining coverage, and the numerous benefits it offers. We’ll also explore how to choose the right plan for your specific needs by comparing different options, considering key factors, and customizing your coverage. Additionally, we’ll shed light on common exclusions in travel insurance policies, the claims process, and tips for maximizing your benefits. From renewals and cancellations to utilizing coverage for medical emergencies and adventure activities, we’ve got you covered. Stay informed about changes in travel insurance policies, learn how to navigate the fine print, and make the most of your coverage. So, let’s embark on this journey together and make sure you have all the knowledge you need to make the most of your USA travel insurance coverage!

Understanding the Basics of USA Travel Insurance Coverage

Credits: onshorekare.com

When it comes to traveling to the USA, it’s important to understand the basics of travel insurance coverage. There are various types of coverage available, including medical coverage, trip cancellation coverage, and baggage loss coverage. Each type of coverage offers different benefits, so it’s essential to carefully consider your needs and choose the right coverage for your trip.

In order to be eligible for USA travel insurance coverage, there are certain requirements that must be met. These requirements may include having a valid visa, providing proof of travel plans, and meeting certain health criteria. It’s important to carefully review the requirements for coverage to ensure that you meet all the necessary criteria and can fully benefit from your insurance policy.

One of the key benefits of USA travel insurance coverage is the peace of mind it provides. With the right coverage, you can travel to the USA knowing that you are protected in case of unexpected events such as illness, trip cancellations, or lost luggage. Travel insurance coverage can also provide financial protection, helping to cover the costs of medical emergencies or trip disruptions, allowing you to enjoy your trip without worrying about potential financial burdens.

Choosing the Right USA Travel Insurance Coverage Plan

Credits: generalitravelinsurance.com

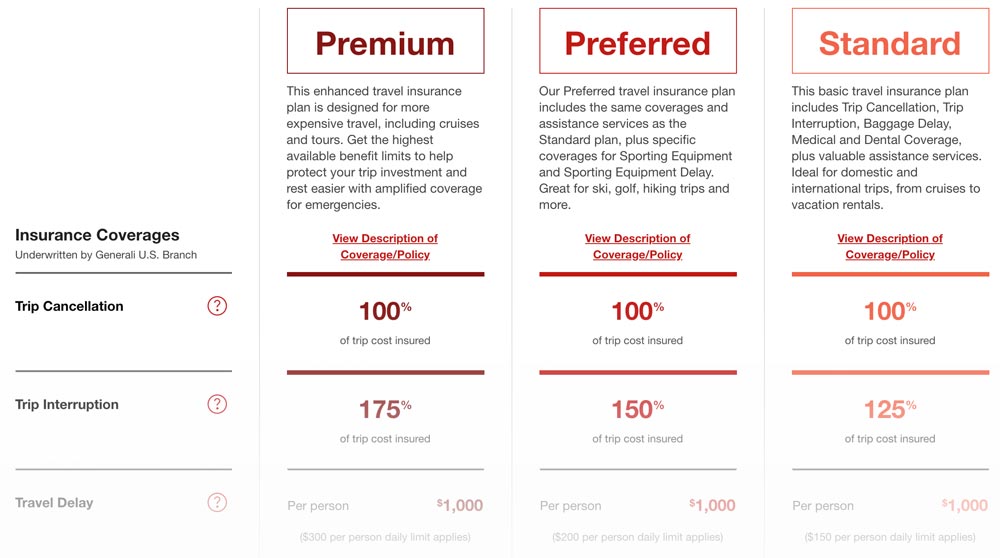

Choosing the right USA travel insurance coverage plan can be an exciting and empowering process. With a wide array of options available, you have the opportunity to tailor your coverage to perfectly fit your needs. Whether you’re looking for basic medical coverage or a comprehensive plan that includes trip cancellation and interruption protection, there’s a plan out there for you. This freedom of choice allows you to select the plan that gives you peace of mind and allows you to fully enjoy your travels without worrying about unexpected mishaps.

When comparing different plans, it’s important to consider factors such as the coverage limits, deductibles, and exclusions. Some plans may offer higher coverage limits for medical expenses, while others may have lower deductibles but higher premiums. Additionally, be sure to pay attention to any pre-existing conditions that may affect your coverage. By carefully evaluating these factors, you can make an informed decision that aligns with your budget and travel needs. This process of comparison and evaluation can be thrilling as you uncover the perfect plan that meets all of your requirements.

One of the most exciting aspects of choosing the right USA travel insurance coverage plan is the ability to customize your coverage. Many insurance providers offer the option to add on additional coverage for specific activities, such as adventure sports or extreme activities, which can be incredibly exhilarating. Furthermore, you can tailor your coverage based on the duration of your trip, whether it’s a short weekend getaway or a long-term international adventure. This level of customization allows you to create a personalized plan that caters to your unique travel style, making the process of selecting the right coverage an exciting and fulfilling experience.

Understanding Exclusions in USA Travel Insurance Coverage

When it comes to understanding exclusions in USA travel insurance coverage, it’s important to be aware of the common exclusions that may apply to your policy. While travel insurance can provide valuable coverage for a variety of unexpected situations, there are certain events and circumstances that are typically not covered. These may include pre-existing medical conditions, high-risk activities such as extreme sports, and acts of terrorism. It’s essential to carefully review the fine print of your policy to fully understand what is and isn’t covered.

One of the key aspects of understanding exclusions in USA travel insurance coverage is to pay close attention to the fine print. While it may be tempting to simply skim over the details of your policy, taking the time to thoroughly review the exclusions and limitations can save you from unpleasant surprises later on. For example, some policies may have specific exclusions for certain destinations or types of travel, so it’s crucial to know exactly what your policy covers before embarking on your trip.

In some cases, you may find that the standard coverage offered by your USA travel insurance policy doesn’t fully meet your needs. Fortunately, there are options for additional coverage that can help fill in the gaps. For example, if you plan to participate in activities that are typically excluded from standard policies, such as scuba diving or mountain climbing, you may be able to purchase a separate add-on to provide coverage for these activities. By understanding the exclusions in your travel insurance coverage and exploring additional options, you can ensure that you have the protection you need for a worry-free trip to the USA.

Making Claims for USA Travel Insurance Coverage

When it comes to making a claim for USA travel insurance coverage, it’s important to have all the necessary documentation in place. This includes receipts for any expenses incurred, medical reports, and a copy of the police report in case of theft or loss. Without the proper documentation, your claim may be delayed or even denied. So, be sure to keep all your paperwork organized and easily accessible in case you need to make a claim.

The claim process for USA travel insurance coverage can vary depending on the insurance provider, but generally, it involves filling out a claim form and submitting all the required documentation. It’s crucial to follow the specific instructions provided by your insurance company to ensure a smooth and efficient claims process. In some cases, you may also need to provide additional information or evidence to support your claim, so be prepared to cooperate fully with the insurance company to expedite the process.

Unfortunately, there are common reasons for claim denial when it comes to USA travel insurance coverage. These can include pre-existing medical conditions, engaging in high-risk activities without proper coverage, or not disclosing accurate information when purchasing the insurance. It’s essential to thoroughly read and understand the terms and conditions of your travel insurance policy to avoid any potential issues with your claim. By being proactive and well-informed, you can increase your chances of a successful claim and receive the coverage you need during your travels in the USA.

Renewing and Cancelling USA Travel Insurance Coverage

Renewing your USA travel insurance coverage is a breeze! With just a few simple steps, you can ensure that your coverage stays up to date and ready for your next adventure. Most insurance providers offer convenient online renewal options, allowing you to quickly and easily extend your coverage without any hassle. Simply log into your account, review your current plan, and select the renewal option that best suits your needs. Some providers even offer automatic renewal, so you can rest assured that your coverage will never lapse.

When it comes to cancelling your USA travel insurance coverage, many providers offer flexible policies to accommodate your needs. Whether your plans have changed or you’ve found a better coverage option, cancelling your current plan is a straightforward process. Most insurance companies allow you to cancel your coverage online or by contacting their customer service team. Be sure to review the cancellation policy outlined in your plan to understand any potential fees or refund options. Some providers may offer a full refund if you cancel within a certain timeframe, while others may prorate your refund based on the remaining coverage period.

In the event that you do need to cancel your USA travel insurance coverage, rest assured that many providers offer refund options to help you recoup some of your investment. Depending on the terms outlined in your plan, you may be eligible for a partial or full refund if you cancel your coverage. Some insurance companies may deduct a small fee for processing the cancellation, while others may offer a seamless refund process with no additional charges. Regardless of the specific policy, it’s always a good idea to review the cancellation terms and refund options before making any changes to your coverage. With the right information in hand, you can confidently renew or cancel your USA travel insurance coverage with ease.

Utilizing USA Travel Insurance Coverage for Medical Emergencies

Credits: covertrip.com

Are you ready for an adventure in the USA? Don’t let the fear of unexpected medical emergencies hold you back! With USA travel insurance coverage, you can explore with peace of mind, knowing that you’re protected in case of any unforeseen health issues. Whether you’re hiking through the Grand Canyon or strolling along the beaches of Hawaii, having travel insurance means you can focus on creating unforgettable memories without worrying about the what-ifs.

In the event of a medical emergency, having access to emergency contact information is crucial. USA travel insurance coverage typically includes a 24/7 assistance hotline, connecting you to trained professionals who can guide you through the next steps. From locating the nearest medical facility to arranging for emergency medical evacuation, you can rest assured that help is just a phone call away. Additionally, understanding the medical coverage details provided by your insurance policy is essential. This may include coverage for hospital stays, doctor’s visits, prescription medications, and more. By familiarizing yourself with the specifics of your coverage, you can make informed decisions and avoid unexpected out-of-pocket expenses.

Furthermore, the reimbursement process for medical expenses incurred during your travels can be straightforward with USA travel insurance coverage. Keep detailed records of all medical treatments and expenses, including receipts and medical reports. When you return home, submit a claim to your insurance provider along with the necessary documentation. In many cases, the reimbursement process is efficient, allowing you to recoup eligible expenses quickly. By understanding the steps involved in utilizing your travel insurance for medical emergencies, you can navigate unforeseen health issues with confidence, knowing that you have the support and financial protection you need.

Understanding USA Travel Insurance Coverage for Adventure Activities

Are you a thrill-seeker looking to explore the adventurous side of the United States? Well, you’re in luck because USA travel insurance coverage also caters to high-risk activities! Whether it’s bungee jumping in the Grand Canyon, white-water rafting in Colorado, or skydiving in California, you can rest assured that your travel insurance will have you covered. That’s right, no need to worry about the what-ifs when you’re out there chasing adrenaline-pumping experiences. Your insurance has got your back, literally!

One of the best parts about USA travel insurance coverage for adventure activities is the inclusion of adventure sports coverage. So, if you’re someone who loves activities like skiing, snowboarding, mountain biking, or rock climbing, you can breathe a sigh of relief knowing that your insurance plan will protect you in case of any mishaps. This means you can fully immerse yourself in the thrill of these high-energy sports without having to constantly worry about potential accidents. With adventure sports coverage, you’re free to let go and enjoy every moment of your adrenaline-fueled adventure!

But what about claims related to adventure activities? Don’t fret, because USA travel insurance has got you covered there too. In the unfortunate event of an injury or accident during your adventurous escapades, you can trust that your insurance provider will handle your claims efficiently. Whether it’s medical expenses, emergency evacuation, or trip interruption due to unforeseen circumstances, your travel insurance coverage will ensure that you are taken care of. So, go ahead and conquer those challenging trails, scale those towering cliffs, and ride those raging rapids, knowing that your insurance has your back every step of the way!

Tips for Maximizing USA Travel Insurance Coverage Benefits

When it comes to maximizing your USA travel insurance coverage benefits, the first step is to familiarize yourself with all the benefits included in your policy. Take the time to thoroughly read through your policy documents and make a note of all the coverages available to you. From trip cancellation and interruption coverage to emergency medical and dental benefits, understanding what your policy includes will help you make the most of your coverage. Once you have a clear understanding of what is covered, you can plan your trip with confidence, knowing that you have the necessary protection in place.

Another important aspect of maximizing your USA travel insurance coverage benefits is to be aware of the coverage limits. Knowing the maximum amount your policy will pay out for certain benefits, such as medical expenses or baggage loss, will help you make informed decisions while traveling. For example, if your policy has a limit on emergency medical expenses, you can take extra precautions to avoid exceeding that limit, such as being mindful of risky activities or ensuring you have adequate medical coverage in your destination. By staying within the coverage limits, you can avoid unnecessary out-of-pocket expenses and make the most of your insurance benefits.

Lastly, in order to fully maximize your USA travel insurance coverage benefits, it’s crucial to familiarize yourself with the process of filing claims efficiently. In the event that you need to make a claim, having a clear understanding of the claims process and requirements will help you navigate through the paperwork and documentation more effectively. This can ultimately result in a quicker claims resolution and reimbursement, allowing you to recover any expenses covered by your policy in a timely manner. By being proactive and organized when it comes to filing claims, you can ensure that you receive the full benefit of your travel insurance coverage.

Staying Informed about Changes in USA Travel Insurance Coverage Policies

Exciting news for travelers! The USA travel insurance coverage policies are constantly evolving, and staying informed about these changes is crucial for anyone planning a trip. Whether it’s policy updates, legal changes, or new coverage options, keeping up to date with the latest developments ensures that you have the best protection possible for your travels. With the travel landscape constantly shifting, it’s important to stay ahead of the game and be aware of any modifications to the coverage policies that may impact your travel plans.

The legal landscape surrounding travel insurance coverage in the USA is always changing, and it’s essential to stay informed about any new regulations or laws that may affect your coverage. From changes in coverage limits to new requirements for specific types of travel, being aware of legal developments can help you make informed decisions about your insurance needs. By staying informed about legal changes, you can ensure that you have the appropriate coverage for your trip and avoid any potential pitfalls that may arise from outdated policies.

In addition to policy updates and legal changes, there are often new coverage options available for travelers in the USA. From enhanced medical coverage to expanded coverage for trip cancellations and interruptions, staying informed about new coverage options can help you tailor your insurance to best suit your individual needs. By keeping abreast of these new offerings, you can ensure that you have the most comprehensive coverage possible for your travels, giving you peace of mind and protection against unforeseen events.

At wealthgists.com, we offer a wide range of financial planning and wealth management services tailored to meet the unique needs of our clients. Our team of experienced professionals is dedicated to helping individuals and businesses achieve their financial goals through strategic investment planning, retirement planning, tax optimization, and risk management. Whether you are looking to build wealth, protect your assets, or plan for a secure retirement, wealthgists.com is committed to providing you with the expert guidance and personalized solutions you need to succeed in today’s ever-changing financial landscape.

Frequently Asked Questions

1. What does USA travel insurance cover?

USA travel insurance typically covers medical emergencies, trip cancellations, lost luggage, and other unexpected events during your trip to the USA.

2. Does USA travel insurance cover pre-existing medical conditions?

Some USA travel insurance plans may offer coverage for pre-existing medical conditions, but it’s important to carefully review the policy details to understand the extent of the coverage.

3. Is emergency medical evacuation included in USA travel insurance?

Many USA travel insurance plans include emergency medical evacuation coverage, which can be crucial in the event of a serious medical emergency while traveling in the USA.

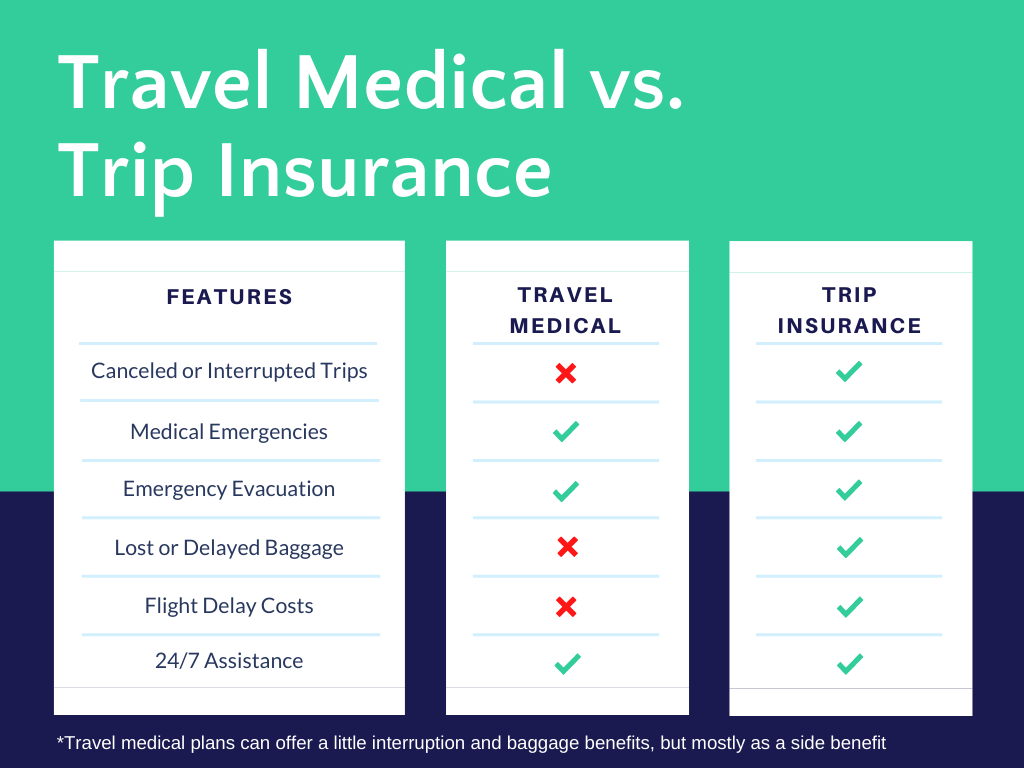

4. What is the difference between travel insurance and travel medical insurance for USA trips?

Travel insurance typically covers a wider range of incidents such as trip cancellations, lost luggage, and medical emergencies, while travel medical insurance focuses specifically on medical coverage during the trip.

5. Do I need USA travel insurance if I have health insurance?

While your regular health insurance may provide some coverage for medical emergencies in the USA, it’s important to consider additional travel insurance to cover other potential travel-related issues such as trip cancellations and lost luggage.

TL;DR: USA Travel Insurance Coverage is essential for any trip to the United States, but it’s important to understand the basics, choose the right plan, and be aware of exclusions and claim processes. Make sure to renew or cancel your coverage as needed, and utilize it for medical emergencies and adventure activities. Maximize your benefits, stay informed about policy changes, and be prepared for any situation while traveling in the USA.